SBI Home Loan Interest Rate: What You Need to Know

Introduction

The State Bank of India (SBI) is the largest public sector bank in India, and its home loan offerings are among the most sought after in the country. As of October 2023, the SBI home loan interest rate has seen noteworthy updates that are crucial for potential homebuyers. Understanding these rates is vital, as they can significantly impact loan affordability and the overall cost of purchasing a home.

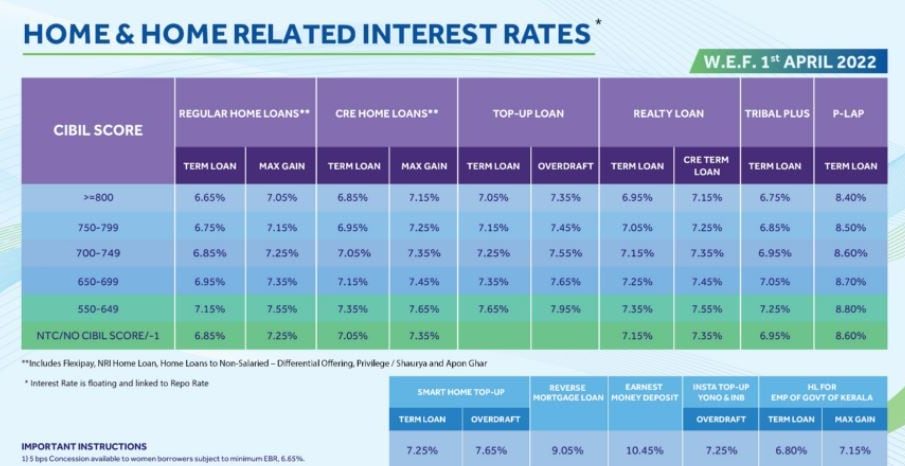

Current Interest Rates

As of now, flexible interest rates for SBI home loans start as low as 8.40% per annum. However, this rate may vary based on several factors including the applicant’s credit score, the loan amount, and the tenure of the loan. Additionally, SBI offers different schemes tailored to various customer segments, which include specific rates for women borrowers, government employees, and first-time homebuyers.

Factors Influencing SBI Home Loan Rates

The SBI home loan interest rates are not set in stone; they are influenced by several factors:

- RBI Monetary Policy: The Reserve Bank of India’s policy decisions regarding the repo rate directly affect the lending rates of banks, including SBI.

- Credit Score: A higher credit score often leads to a lower interest rate as it indicates less risk to the bank.

- Loan Amount and Tenure: SBI offers competitive rates for larger loan amounts or for loans with extended tenures.

Availability and Ease of Access

SBI has made the application process for home loans exceptionally user-friendly, with options to apply online or through physical branches. Prospective borrowers can also utilize the bank’s online calculators to estimate their EMIs and understand their repayment obligations better.

Conclusion

The importance of keeping abreast of SBI home loan interest rates cannot be overstated. A slight change in interest rates can lead to significant savings or costs over the life of the loan. For those considering purchasing a home, staying informed and potentially locking in a favorable rate is crucial. As policies and economic conditions evolve, predictions suggest that interest rates may fluctuate in the future, making it essential for homebuyers to do their research and consult with their financial advisors before making long-term commitments.