Understanding the Nikkei 225: Significance and Trends

Introduction to the Nikkei 225

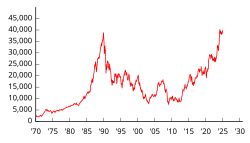

The Nikkei 225 index represents Japan’s leading stock market index, composed of 225 significant companies listed on the Tokyo Stock Exchange. As one of the major global indices, the performance of the Nikkei 225 greatly influences investor sentiments and economic forecasts across Asia and the rest of the world. Given the economic fluctuations and recovery patterns following the pandemic, the relevance of tracking this index has escalated among investors and analysts.

Current Trends in the Nikkei 225

As of early October 2023, the Nikkei 225 has shown resilient growth, buoyed by strong corporate earnings reports and a recovery in consumer spending in Japan. Recently, the index crossed the 30,000-mark, a milestone not seen since the early 1990s, signifying heightened investor confidence and a gradual economic recovery. Key sectors contributing to this momentum include technology, automotive, and finance, with companies such as Sony and Toyota leading the charge.

Moreover, Japan’s government has implemented various stimulus packages and monetary policies designed to spur economic growth, which have positively affected market sentiments. The easing of COVID-19 restrictions has also aided in the revival of domestic consumption, further reflecting in the Nikkei’s upward trend. In addition, the Bank of Japan’s commitment to maintaining low-interest rates has made investments more appealing, pushing more capital towards the equities market.

Implications and Conclusion

The performance of the Nikkei 225 has several implications for global investors and markets. As Japan is a significant player in the Asian economy, its influence extends beyond its borders, impacting trade relations and investment trends in the region. As the index continues to build momentum, market analysts suggest a continued focus on the technological sector as well as the financial and automotive industries, particularly concerning innovations and sustainability efforts.

Looking ahead, while the Nikkei 225 appears sturdy in the short term, external factors such as geopolitical tensions, potential changes in U.S. monetary policy, and global supply chain issues could present challenges. Investors are encouraged to remain vigilant and consider these dynamics while assessing their investment strategies. The ongoing performance of the Nikkei 225 will certainly play a critical role in shaping economic events in Asia and beyond in the coming months.