Tata Power Stock Recommendations: Insights for Investors

Introduction

Tata Power, a leading player in the Indian energy sector, has gained significant traction among investors due to its ambitious expansion plans and commitment to renewable energy. As the world shifts towards sustainable practices, Tata Power’s transition into clean energy makes it a relevant choice for both investors and analysts.

Current Market Performance

As of October 2023, Tata Power’s stock has shown resilience in fluctuating market conditions. The stock is trading at ₹252, reflecting a growth of over 15% year-to-date. Analysts attribute this rise to the company’s successful project execution, particularly in solar and hydroelectric power. Recent reports indicate that Tata Power’s Q2 earnings saw a 20% increase in net profit, signaling strong operational performance. Additionally, initiatives like the development of battery storage solutions have further excited market observers.

Expert Recommendations

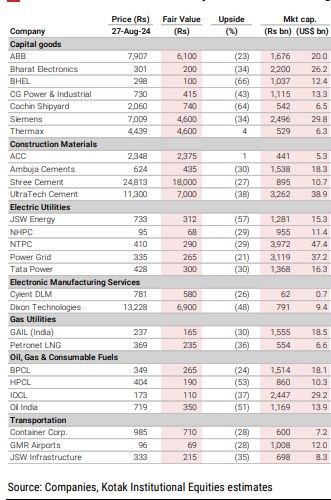

Several financial experts and brokerages have provided their insights on Tata Power’s stock. According to a recent report by ICICI Securities, they maintain a ‘Buy’ rating on the stock, with a target price set at ₹300, indicating a significant upside. They emphasize Tata Power’s strategic investments in renewable energy and distribution capabilities, which are likely to enhance its growth trajectory.

Similarly, Motilal Oswal has a bullish outlook, citing the company’s diverse energy portfolios and government support for green initiatives. Their analysts recommend long-term investors to consider accumulating shares, as they predict substantial growth driven by the renewable energy sector’s expansion.

Investment Outlook

For investors looking at Tata Power, it is essential to consider both the potential rewards and inherent risks. The global shift towards electric vehicles and a low-carbon economy bolsters Tata Power’s future prospects. However, investors must also keep an eye on policy changes and regulatory developments that could impact profitability.

Conclusion

In conclusion, Tata Power presents a compelling case for investment in the current market environment. With positive financial indicators and strong expert recommendations, it is positioned as a promising stock for those interested in energy sector investments. As renewable energy continues to gain traction, Tata Power’s commitment to sustainable growth could translate into significant value for shareholders. Investors are advised to conduct thorough research and consider their risk appetite before making any investment decisions.