Current Trends in Rpower Share Price

Introduction

The share price of Reliance Power (Rpower) is a significant indicator of the company’s market performance and investor sentiment. As an influential player in the Indian energy sector, Rpower’s stock trends can reflect broader industry changes and economic conditions. In recent times, the fluctuations in Rpower’s share price have attracted considerable attention from investors and analysts alike, making it essential to stay updated on its developments.

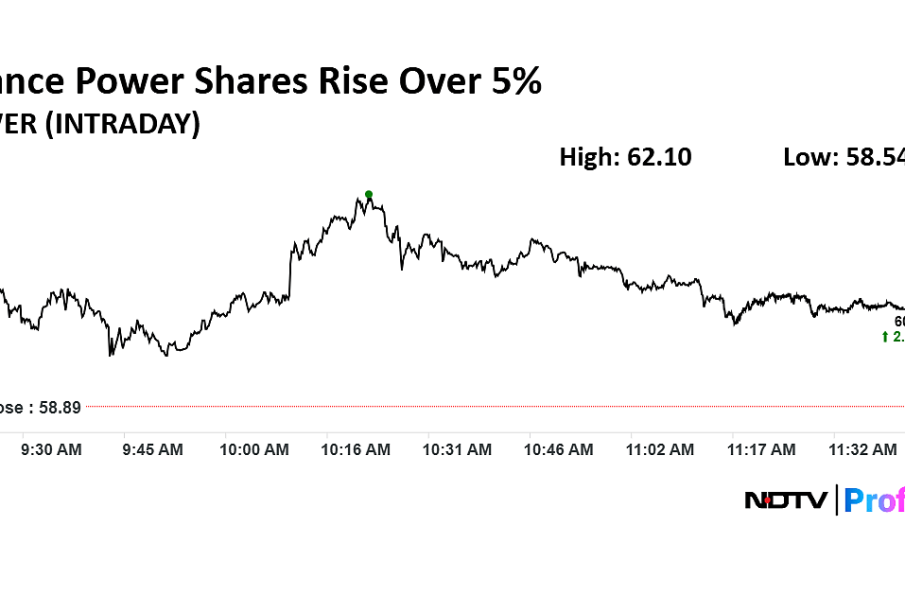

Market Performance Overview

As of the latest reports from October 2023, Rpower’s share price has experienced a moderate uptick, trading at around ₹18.25, which marks an increase of approximately 4% from the previous week’s close. This rise can be attributed to several factors, including recent strategic initiatives taken by the company to improve operational efficiencies and enhance its project execution timeline. Analysts suggest that the decision to expedite the commissioning of its various power generation projects may have positively influenced investor confidence.

Recent Developments

Recently, Rpower announced the completion of its 1,200 MW power project in Madhya Pradesh, which is expected to significantly contribute to its profitability in the coming quarters. Additionally, the company is actively engaging in renewable energy projects, aligning with India’s vision of increasing its green energy portfolio. As the government pushes for cleaner energy solutions, Rpower’s investments in solar and wind energy could enhance its market position.

Expert Opinions

Market experts have expressed mixed sentiments regarding Rpower’s share price trajectory. Some analysts remain optimistic, citing the company’s aggressive expansion into renewable resources and expected improvements in financial performance. However, others caution that ongoing regulatory uncertainties and competition within the energy sector may pose risks. Moreover, the broader economic environment, including fluctuations in coal prices and global demand, could impact Rpower’s future growth.

Conclusion

For investors keeping a close watch on Rpower share price, it is essential to consider both the current market dynamics and the company’s strategic direction. While recent developments suggest a cautiously optimistic outlook, potential investors should remain vigilant of economic indicators and regulatory changes that could impact the stock’s performance. The energy sector remains volatile, and thus, staying informed will be key for making educated investment decisions.