Current Trends in JSW Energy Share Price

Importance of JSW Energy in the Market

JSW Energy Limited is a significant player in the Indian power sector, known for its diverse portfolio that includes thermal, hydro, and renewable energy projects. As the global focus shifts towards sustainable energy solutions, the demand for companies like JSW Energy is on the rise, making its share price a topic of critical interest for investors.

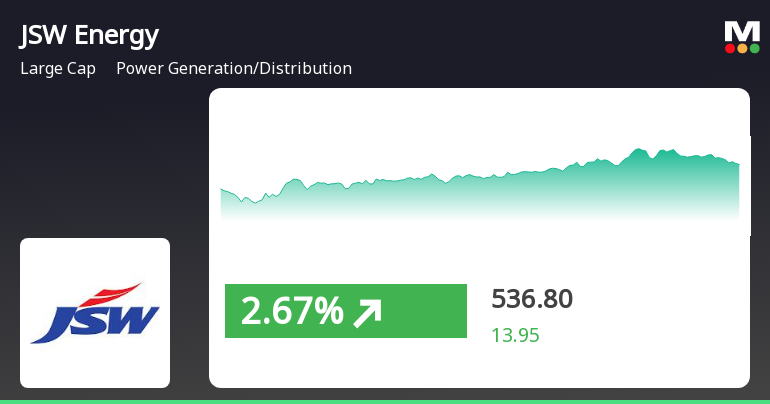

Current Share Price Analysis

As of October 2023, the JSW Energy share price is experiencing notable fluctuations influenced by various market factors. On the Bombay Stock Exchange (BSE), the stocks were trading around INR 275, with a slight increase of 2% since the beginning of the month. Analysts attribute this positive trend to the company’s robust financial performance in recent quarters and its strategic initiatives aimed at expanding its renewable energy capabilities.

Factors Influencing Share Price

Numerous factors are contributing to the current share price of JSW Energy:

- Government Policies: The Indian government’s push towards renewable energy and the implementation of favorable policies are boosting investor confidence.

- Quarterly Earnings: The recent quarterly results exceeded market expectations, showcasing an increase in revenue and profit margins.

- Market Sentiment: The overall sentiment surrounding energy stocks has been positive due to the global energy crisis, which boosts the demand for established players in the sector.

Future Outlook

Looking ahead, market experts are optimistic about the future of JSW Energy. The company’s commitment to sustainability and its aggressive expansion plans in the renewable sector are likely to keep the share price on an upward trajectory. Many analysts predict that if the current trends continue, it could lead to further investment inflows, ultimately reflecting positively on the share price.

Conclusion

The current fluctuations in the JSW Energy share price underscore the dynamic nature of the energy market and investor behavior. Given the company’s strategic direction and the favorable market conditions, investors should watch its stock closely in the coming months. Staying informed about both macroeconomic indicators and company-specific developments will be crucial for making informed investment decisions.