Latest Update on TCS Share Price: Trends and Predictions

Introduction

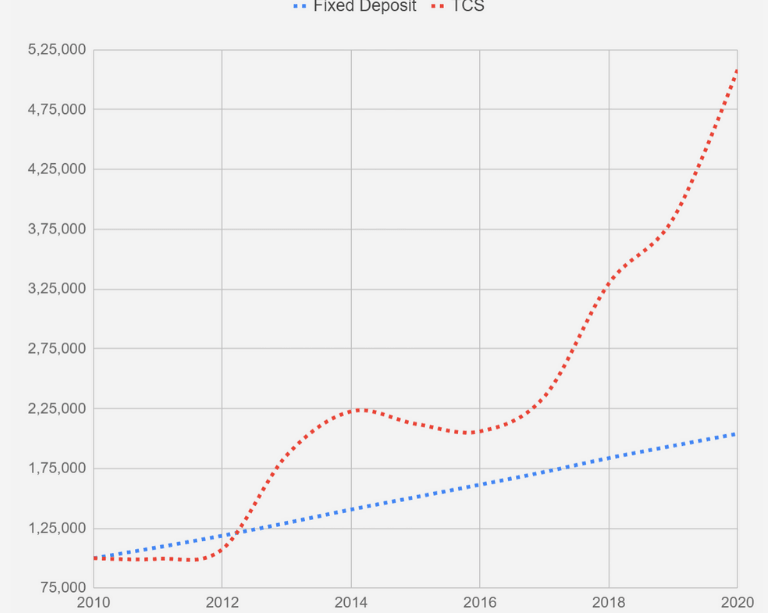

The share price of Tata Consultancy Services (TCS), one of India’s leading IT services and consulting firms, holds significant relevance for investors and market analysts. With the increasing digitization of businesses globally, TCS has positioned itself as a major player in the technology sector. Understanding the fluctuations in TCS share prices can provide insights into the overall health of the market and the tech industry.

Current Market Performance

As of the latest data from October 2023, TCS shares have experienced some volatility. The current share price stands at approximately ₹3,500, reflecting a modest increase of 1.5% over the past week. Factors influencing this rise include positive quarterly earnings reported earlier this month, indicating a revenue growth of 5% year-over-year. This growth has encouraged bullish sentiments among investors.

Key Influencing Factors

Several factors contribute to the fluctuations in TCS’s share price:

- Quarterly Earnings Reports: TCS’s latest financial results demonstrated resilience amidst global economic challenges, which has positively impacted investor confidence.

- Market Trends: The overall performance of the Nifty IT index has been a significant influence on TCS’s stock movements, as tech stocks often move in tandem.

- Global Economic Indicators: Economic indicators such as inflation rates, U.S. employment data, and geopolitical tensions also play a crucial role in shaping market predictions.

Expert Predictions

Financial analysts project a cautiously optimistic outlook for TCS in the coming quarters. With many businesses shifting towards digital solutions, demands for IT services are likely to remain high. Some analysts predict that TCS could reach a target price of ₹3,700 within the next three months, driven by ongoing digital transformation initiatives across various sectors. However, they also caution that potential global economic downturns could pose risks to this forecast.

Conclusion

In conclusion, TCS share price is a critical metric to watch for investors seeking exposure to the technology sector. With solid fundamentals, recent positive earnings, and a shifting market landscape, TCS holds promise for future growth. Nonetheless, potential investors should approach the stock with caution and stay informed about global economic conditions. Monitoring TCS’s financial developments will be key to understanding its trajectory in the volatile market environment.