Understanding the Dow Jones Industrial Average in Current Market

Introduction

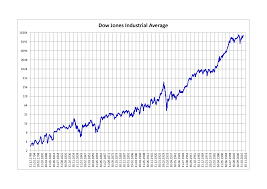

The Dow Jones Industrial Average (DJIA) is one of the most recognized stock market indices worldwide and serves as a key indicator of the overall health of the economy. Established in 1896, the DJIA tracks the performance of 30 significant publicly traded companies in the United States. Understanding its movements is essential for investors, analysts, and anyone interested in market trends, especially given the index’s recent fluctuations linked to inflation rates and global economic conditions.

Current Trends of the Dow Jones Industrial Average

As of the latest figures from October 2023, the Dow Jones Industrial Average has experienced notable volatility influenced by various economic factors. Recently, its value has hovered around the 34,000 mark, a significant rebound compared to the lows observed earlier this year. Analysts attribute this recovery to a combination of strong corporate earnings reports, particularly from sectors like technology and consumer goods, and stability in job growth amidst economic uncertainties.

In recent weeks, the Federal Reserve’s stance on interest rates has also played a crucial role. As inflation continues to be a concern, the anticipation of potential interest rate hikes has led to fluctuations in investor confidence. In a recent statement, Fed Chair Jerome Powell indicated a data-driven approach to monetary policy, impacting investor outlook significantly—an announcement that resulted in a temporary uptick in the DJIA.

Factors Influencing the DJIA

The DJIA is sensitive not only to domestic issues such as interest rates and inflation but also to international events. Geopolitical tensions and trade agreements can sway investor sentiment and impact stock prices. For instance, ongoing discussions regarding international supply chain issues and the energy crisis further complicate the economic landscape, influencing the performance of companies that make up the DJIA.

Furthermore, investor sentiment remains robust as earnings seasons approach and companies begin to report their performances for the third quarter. Many analysts expect strong results, particularly from technology companies that thrive in digital transformations ushered by the pandemic’s lasting impacts.

Conclusion

The Dow Jones Industrial Average remains a critical barometer of market sentiment and an important tool for understanding economic trends. As we approach the end of 2023, investors and analysts alike will be keeping a close eye on the DJIA for indications of sustained growth or signals of potential downturns. The interplay of corporate earnings, interest rates, and global economic factors will be pivotal in shaping its trajectory in the coming months. For retail investors and market watchers, staying informed about these trends will be vital for navigation through the increasingly complex financial landscape.