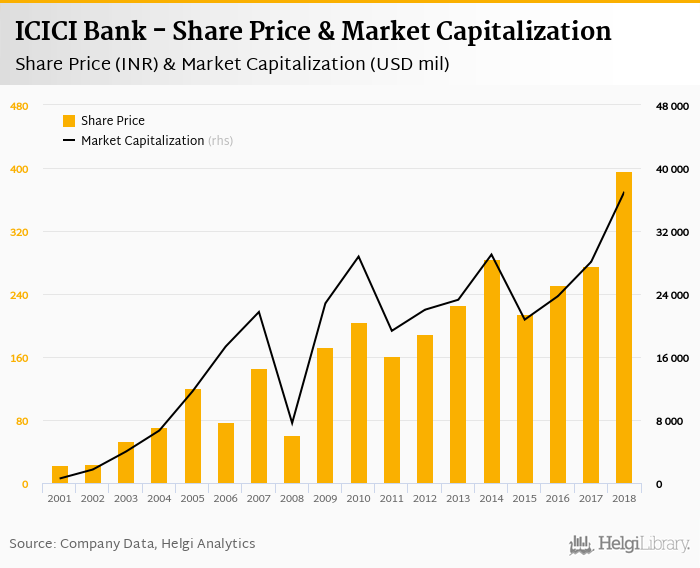

Current Trends in ICICI Bank Share Price

Introduction

The share price of ICICI Bank, one of India’s leading private sector banks, is a significant indicator of the banking sector’s health in the stock market. As investors closely monitor its performance, understanding the factors influencing the share price is critical for making informed investment decisions. The current fluctuations in share prices reflect broader economic conditions, monetary policy changes, and the bank’s financial health.

Current Share Price and Trends

As of October 2023, ICICI Bank’s share price is exhibiting considerable volatility, trading around INR 940 per share. Over the past month, the stock has seen a rise of approximately 5%, largely attributed to positive earnings reports and an optimistic outlook from analysts predicting growth in the retail and corporate loan segments.

Factors Influencing ICICI Bank Share Price

Several factors have been influencing the share price of ICICI Bank:

- Financial Performance: The bank reported a 20% increase in net profit for Q2 FY2023, which has bolstered investor confidence.

- Market Sentiment: Rising interest rates have favored banks, leading to expectations of improved net interest margins, positively impacting share prices.

- Regulatory Environment: Favorable regulatory policies and a stable economic environment in India have made banking stocks like ICICI Bank more appealing.

- Competitor Analysis: Compared to other private sector banks, ICICI has been performing better, enhancing its market position.

Expert Insights and Forecasts

Market analysts have varied opinions on the future trajectory of ICICI Bank’s share price. While some see potential for further growth due to its robust fundamentals and expanding digital banking services, others caution about macroeconomic headwinds such as inflation and geopolitical uncertainties. Analysts project a target price in the range of INR 1,000 to INR 1,050 in the next 6 months, which signals optimistic sentiment about the bank’s strategic initiatives.

Conclusion

The ICICI Bank share price is a reflection of both domestic and global market conditions. Investors should keep a close watch on key financial indicators and market trends to make informed investment choices. The current positive outlook from analysts suggests that ICICI Bank could be a valuable component of a diversified investment portfolio, although remaining aware of potential risks is crucial for navigating a dynamic stock market.