Current Trends and Insights on IFCI Share Price

Introduction

The IFCI Limited, or Industrial Finance Corporation of India, is a financial institution that plays a crucial role in supporting the growth of small and medium enterprises (SMEs) in India. Keeping a close tab on the IFCI share price is essential for investors and stakeholders as it reflects the company’s financial performance and market sentiment. As India recovers from the economic impacts of the pandemic and moves towards sustainable growth, the stock market is a significant factor for many investors.

Current Share Price Dynamics

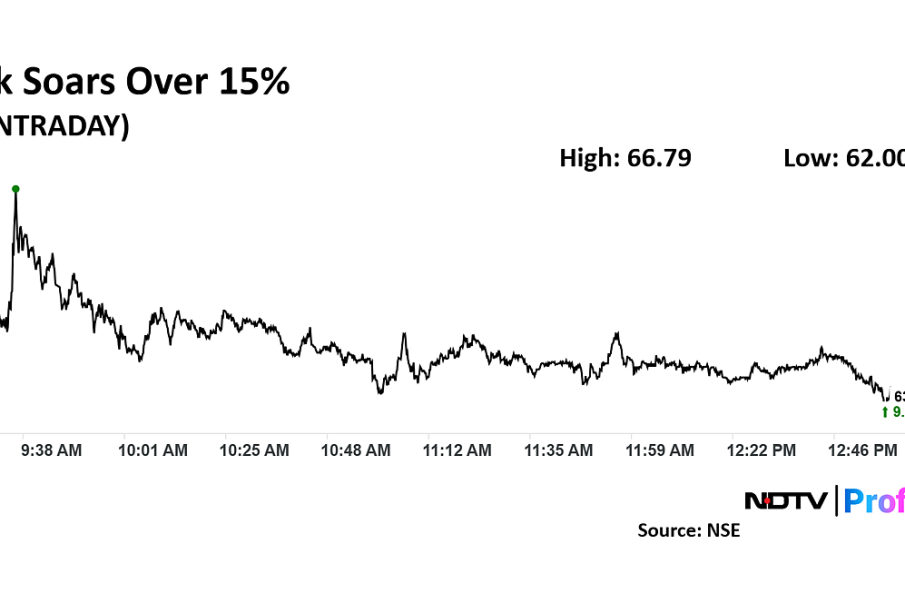

As of the latest trading session on October 25, 2023, the IFCI share price is witnessing fluctuations influenced by various economic indicators and market trends. The stock opened at INR 18.50 and has shown a 5-day moving average indicating a slight upward trend, closing at INR 19.30 yesterday. Analysts attribute this rise to recent positive quarterly results reported by IFCI, showcasing an increase in net profits by 15% compared to the previous quarter.

Market Sentiment

Investors’ confidence in IFCI is also bolstered by the announcement of new policies aimed at infrastructure funding, which align with the Indian government’s push for economic recovery. Furthermore, the performance of the banking sector has shown robust improvement, leading to a ripple effect across financial stocks, including IFCI. Additionally, the recent reduction in interest rates has enhanced borrowing potential, further positioning IFCI as a key player in financing growth.

Future Outlook

Looking ahead, market analysts remain cautiously optimistic about the IFCI share price trajectory. With the continuous focus on financial inclusion and growth in the SME sector, predictions for the next quarter indicate a possible rise as investor sentiment remains positive. It is expected that any significant policy changes or economic developments could further influence IFCI’s stock performance. Investors are advised to stay informed about broader economic trends as well as any corporate announcements from IFCI.

Conclusion

In summary, the IFCI share price reflects essential market dynamics and the current economic environment in India. As it continues to adapt to changes and potential growth opportunities, stakeholders must remain vigilant. Understanding the factors that influence stock performance is key for making informed investment decisions in the evolving landscape of Indian finance.