Understanding SEPC Share Price: Trends and Market Insights

Introduction

The share price of SEPC (Sikkim Engineering Projects Limited) has garnered significant attention from investors and analysts alike, especially in the context of the growing infrastructure development in India. Understanding the trends and fluctuations in SEPC’s stock price is crucial for current and potential investors looking to navigate the turbulent waters of the stock market.

Current Trends in SEPC Share Price

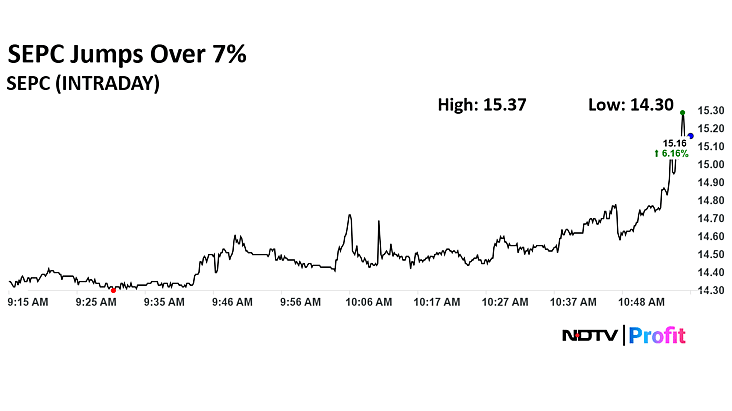

As of October 2023, SEPC’s share price has exhibited volatility, influenced by various factors, including quarterly earnings reports, government contracts, and overall market sentiment towards infrastructure sectors. Recently, the company reported a modest increase of 5% in its share price following the announcement of several key government contracts aimed at improving infrastructure in remote areas of Sikkim and adjacent regions.

Market Performance

In the last quarter, SEPC shares have been trading in the range of INR 45 to INR 60. Industry analysts note that the company’s strategic focus on renewable energy projects and civil construction is attracting investor interest. The recent government incentives for infrastructure projects have also positively impacted SEPC’s market performance, with a forecasted growth in orders expected to support price stability and potential increases in the latter half of the fiscal year.

Factors Influencing SEPC’s Share Price

Various factors impact the share price of SEPC:

- Government Policies: Initiatives aimed at bolstering infrastructure and construction can significantly enhance the company’s revenue potential.

- Market Competition: The presence of competing firms in the civil engineering space often influences pricing and profitability, affecting investor sentiment.

- Global Economic Trends: Economic health on a broader scale impacts investor confidence and spending habits, thereby directly impacting SEPC’s projects and profitability.

Conclusion

In summary, the current SEPC share price reflects both challenges and opportunities shaped by the company’s strategic directions and external market forces. For investors, the outlook seems cautiously optimistic as the emphasis on infrastructure continues to grow in India. Analysts recommend keeping a close eye on upcoming earnings reports and government policy changes, which could provide further insights into the stability and potential rise of SEPC’s stock in the forthcoming months. As always, investors are encouraged to perform due diligence and consider market trends before making investment decisions.