Current Trends and Analysis of Qualcomm Share Price

Introduction

Qualcomm Incorporated, a global leader in semiconductor technology, has been making headlines with its share price fluctuations recently. As a key player in the wireless technology domain, Qualcomm’s performance is closely watched by investors and analysts alike. Understanding the trends in Qualcomm’s share price is crucial for stakeholders looking to make informed investment decisions in the tech sector.

Recent Trends in Qualcomm Share Price

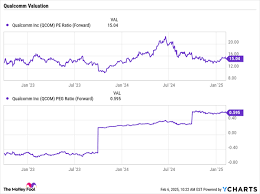

As of October 2023, Qualcomm’s share price has seen notable volatility influenced by various market factors. In the past month, the stock has experienced a fluctuation between $100 and $120 per share. This fluctuation can be attributed to multiple dynamics in the technology and semiconductor industries, as well as ongoing global supply chain challenges.

On October 10, Qualcomm reported its financial results for the fourth quarter of the fiscal year, which showed a solid earnings per share (EPS) despite a decrease in overall revenue compared to the previous year. Investors reacted positively to the EPS, leading to a temporary boost in the share price, which peaked at $115 before retreating slightly due to profit-taking by some investors.

Key Factors Influencing Share Price

Several factors are currently impacting Qualcomm’s share price:

- Global Chip Shortage: The ongoing semiconductor shortage continues to affect production timelines and delivery rates, impacting revenue prospects.

- 5G Adoption: As 5G technology gains traction globally, Qualcomm remains at the forefront, with increasing demand for its chipsets.

- Market Competition: Competition from other chip manufacturers impacts investor sentiment; companies such as AMD and NVIDIA pose significant challenges.

- Regulations and Trade Policies: Changes in trade policies and regulations, especially between the U.S. and China, can create volatility for Qualcomm’s stock.

Conclusion

Overall, stakeholders watching Qualcomm’s share price must consider both short-term fluctuations and long-term trends in the technology and semiconductor sectors. With increasing demand for 5G technology and continued adaptation to market challenges, Qualcomm may present growth opportunities for investors. However, with potential risks from market competition and global economic conditions, it remains imperative for investors to stay informed on industry developments that could impact Qualcomm’s share price trajectory.