Understanding the Importance of the Dow Jones Index

Introduction

The Dow Jones Index, one of the most recognized stock market indices in the world, serves as a crucial indicator of the health of the U.S. economy. Tracking 30 significant publicly traded companies, the index reflects the performance of major sectors and provides insights into market trends. As global economic conditions fluctuate, understanding the Dow Jones Index becomes increasingly important for investors and analysts alike.

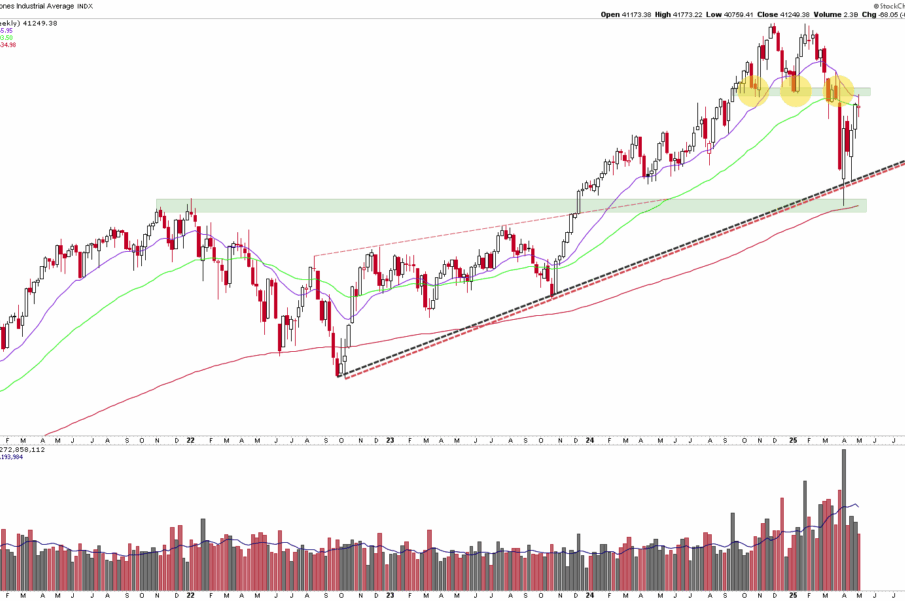

Recent Trends and Performance

As of mid-October 2023, the Dow Jones Index has experienced notable volatility driven by a variety of economic factors. Recent reports indicate that the index has fluctuated within a range of 30,000 to 35,000 points. Significant contributors to this volatility include changing Federal Reserve policies, inflation rates, and geopolitical tensions. Analysts have pointed out that the market has reacted sharply to announcements regarding interest rate hikes, particularly as inflation continues to affect consumer spending. The tech sector, represented by companies like Apple and Microsoft, has also influenced the index’s performance despite facing challenges from supply chain disruptions.

Impact of Interest Rates

The Federal Reserve’s stance on interest rates remains a focal point for investors. In September 2023, the Fed maintained its decision to keep rates steady, but indications of potential hikes in the near future have left investors uncertain. Higher interest rates typically lead to increased borrowing costs, negatively impacting consumer spending and corporate profits. As a result, any movements in interest rates will likely have a cascading effect on the Dow Jones Index, mirroring broader economic sentiments.

Geopolitical Factors

Another factor influencing the index is geopolitical stability, particularly involving U.S.-China relations and the ongoing conflict in Ukraine. These factors not only affect global trade but also the stock market’s overall outlook. Concerns over supply chain disruptions due to geopolitical issues lead investors to respond swiftly, often triggering fluctuations within the Dow.

Conclusion

The Dow Jones Index remains a vital tool for assessing economic health and market performance. As we move towards the end of 2023, market watchers and investors are advised to stay informed about economic indicators, Federal Reserve actions, and global events that may impact the index. The performance of the index in upcoming months will be a critical barometer for economic recovery. Given the current landscape, predicting the direction of the Dow Jones requires careful consideration of both domestic and international developments, making it an essential focus for investors and economic analysts moving forward.