Latest Updates on IDBI Share Price: Trends and Analysis

Introduction

The share price of IDBI Bank has been a significant focus for market analysts and investors, especially given the evolving landscape of the Indian banking sector. With a shift towards digital banking and a focus on improving asset quality, IDBI Bank’s market performance reflects broader economic trends. Understanding IDBI’s share price is essential for potential investors and stakeholders as it can indicate the bank’s financial health and growth prospects.

Current Performance

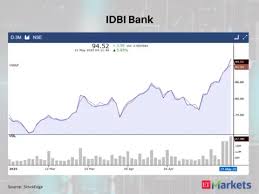

As of the latest trading session on October 20, 2023, IDBI Bank’s shares are trading at around ₹58.35 per share. This marks a notable increase of approximately 2.50% from the previous trading session, where shares closed at ₹56.84. Over the past month, the stock has experienced fluctuations, reaching a high of ₹60.50 and a low of ₹53.70. The share price growth is attributed to the bank’s improved quarterly earnings, a significant reduction in non-performing assets, and a strategic focus on retail banking.

Market Trends and Analyst Predictions

Market analysts have shown optimism towards IDBI Bank’s share price prospects. Many analysts expect that, with consistent performance in retail and corporate lending segments, the bank could potentially see its stock prices rise further. The implementation of the bank’s new digital initiatives is also expected to attract more customers, improve operational efficiency, and ultimately boost growth. Analysts predict that IDBI shares could reach ₹65 within the next three to six months, assuming broader market conditions remain favorable.

Significance for Investors

For current and prospective investors, monitoring the IDBI share price is crucial. Given the recent uptick and positive sentiment in the banking sector post-reforms, IDBI Bank represents an interesting opportunity. The bank’s focus on profitability and shareholder value enhancement makes it a potentially attractive stock. However, investors should remain cautious and undertake thorough research, considering macroeconomic factors and the bank’s performance metrics.

Conclusion

The IDBI share price is not only indicative of the bank’s individual performance but also reflects the overall health of the Indian banking sector. As digital transformation continues, coupled with strategic initiatives to improve asset quality, IDBI Bank may offer promising returns in the future. Investors are advised to keep a close eye on market developments, regulatory changes, and the bank’s quarterly results, which will be pivotal in shaping the future trajectory of IDBI’s share price.