Dixon Share Price: Latest Trends and Insights

Introduction

The share price of Dixon Technologies, a leading player in the Indian electronics manufacturing industry, has been a focal point for investors and analysts alike. Understanding the trends and factors influencing its share price is crucial for making informed investment decisions. As India’s demand for electronics continues to soar, Dixon’s performance in the market is more relevant than ever.

Current Trends in Dixon Share Price

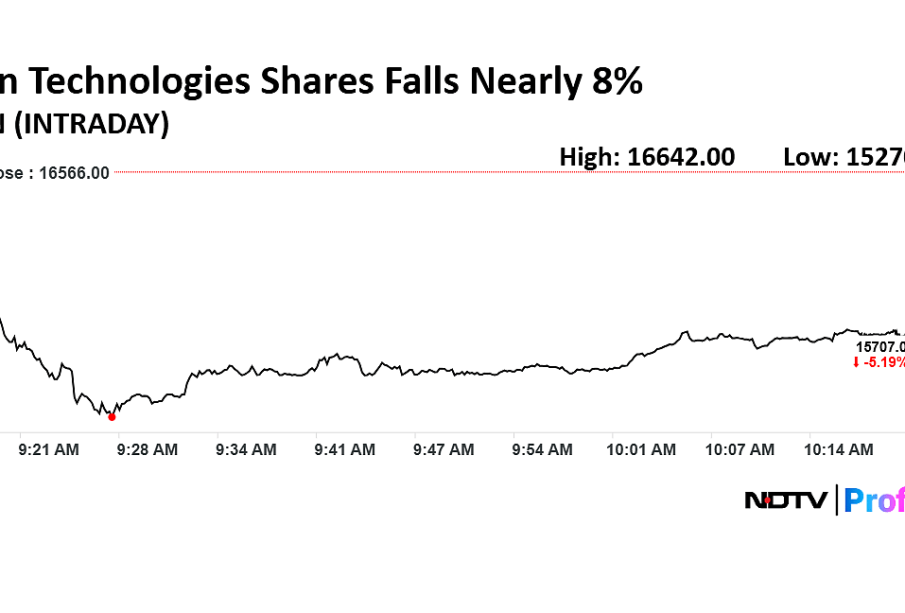

As of October 2023, Dixon Technologies’ share price has shown considerable volatility. After reaching a high of INR 5,000 earlier this year, the stock has adjusted to approximately INR 4,700 following a series of market corrections. Analysts attribute this fluctuation to several key factors, including shifts in consumer demand, the impact of global supply chain disruptions, and changes in government policies regarding manufacturing incentives.

Factors Influencing Share Price

1. **Market Demand**: The ongoing growth in electronic product demand, including mobile phones and home appliances, has a direct impact on Dixon’s revenue and share price.

2. **Performance Reports**: Recent quarterly results showed a 20% increase in net profit, albeit below market expectations, leading to some investor caution.

3. **Global Supply Chain Issues**: With the pandemic’s lingering effects, supply chain challenges have limited production capabilities, impacting overall sales and investor sentiment.

4. **Government Incentives**: The Indian government’s PLI (Production-Linked Incentive) scheme for electronics manufacturing aims to boost domestic production. Success in leveraging these policies could improve Dixon’s market position and share value.

Conclusion

In summary, Dixon Technologies’ share price remains an essential barometer for the Indian electronics sector. While the current fluctuations may indicate uncertainty, the underlying fundamentals suggest potential for recovery as macroeconomic conditions stabilize. Investors must keep a keen eye on market trends, quarterly earnings reports, and governmental policies to gauge the potential direction of Dixon’s share price. As industries evolve and navigate challenges, Dixon’s ability to adapt will be fundamental in determining its future trajectory in the stock market.