Latest Trends in BEL Share Price: What Investors Should Know

Importance of Tracking BEL Share Price

The Bharat Electronics Limited (BEL) share price is a significant indicator of the company’s performance and influence within the Indian defense sector. Tracking the BEL share price is essential for investors, analysts, and anyone interested in the stock market as it reflects the company’s operational success and market conditions.

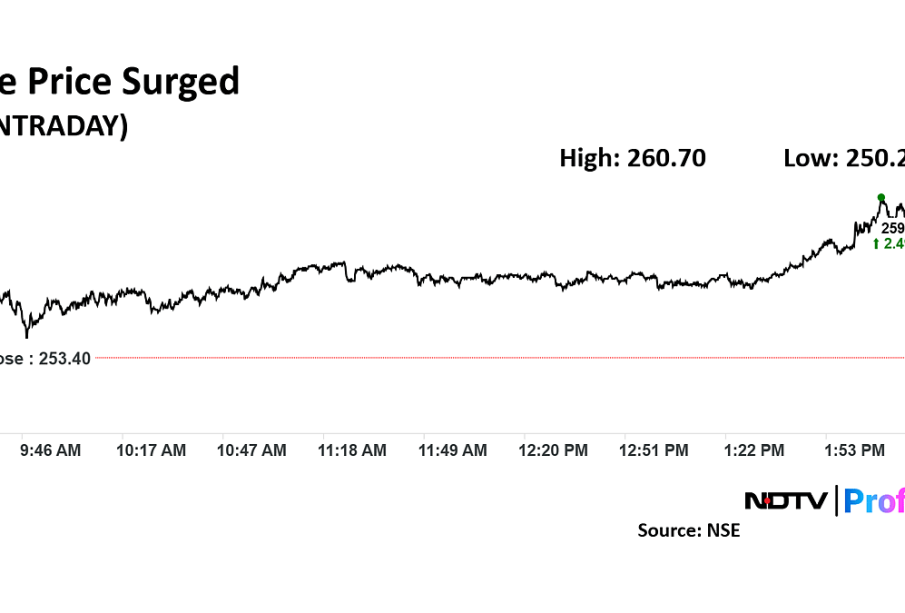

Recent Performance and Current Trends

As of October 2023, BEL has experienced notable fluctuations in its share price. Over the last month, analysts have observed an increase in demand for its stocks, leading to a rise in the share price. At present, BEL’s stock is trading at approximately ₹100 per share, with projections indicating further movements based on upcoming financial results and market conditions.

Factors Influencing BEL Share Price

Several factors contribute to changes in the BEL share price. Key among these are:

- Government Contracts: As a public sector enterprise, BEL’s revenue is significantly affected by government defense contracts. Recent announcements regarding defense spending increases are likely to influence share prices positively.

- Market Sentiment: Overall market trends and investor sentiment can lead to short-term fluctuations in BEL shares. For instance, bullish sentiments within the Indian stock market can enhance BEL’s performance.

- Financial Health: Quarterly earnings reports play a pivotal role in shaping investor perceptions. Any positive surprises in earnings or guidance can boost the stock price.

Current Market Sentiment

Investor confidence in BEL stock has been bolstered by positive earnings results from the last quarter. Furthermore, increasing government allocations toward defense procurement and modernization efforts have positioned BEL favorably in the eyes of market analysts. Investors remain cautiously optimistic, with many forecasting a potential rise in the BEL share price in the coming months.

Conclusion: Future Projections

In conclusion, following the BEL share price is essential for prospective and existing investors looking to make informed decisions. Given the company’s robust order book, supportive government policies, and positive market outlook, analysts anticipate that BEL shares could witness upward momentum. However, investors should remain vigilant and ready to respond to market developments and economic conditions. As always, thorough research and consideration of risk factors are essential before making investment choices.