Current Trends in DLF Share Price: Analyzing the Market Movements

Introduction

The DLF Limited’s share price is a crucial indicator for investors and stakeholders in the Indian real estate sector. As one of the largest real estate developers in India, fluctuations in its share price can significantly reflect market trends and investor sentiment. With recent developments in the housing market and changes in economic policies, monitoring the DLF share price has become increasingly relevant for both potential investors and industry analysts.

Recent Market Performance

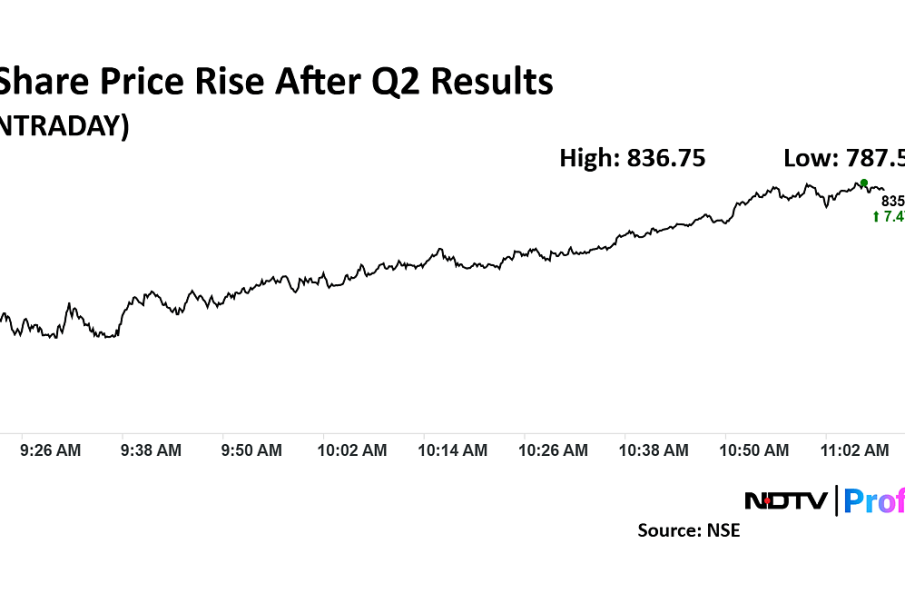

As of October 2023, the DLF share price has shown a notable uptick, owing to several internal and external factors. Over the past month, the stock price has risen by approximately 8%, resulting in a current market valuation hovering around ₹440. Market analysts attribute this increase to the company’s robust quarterly earnings report, which exceeded analysts’ expectations and highlighted strong sales in its residential segment.

Furthermore, DLF has been expanding its portfolio with new developments, including luxury residential complexes and commercial spaces. This diversification strategy has attracted more investors, boosting share demand. Additionally, the company’s strategic partnerships and collaborations in the real estate market have positioned it favorably against competitors.

Factors Influencing DLF Share Price

Several factors play a crucial role in influencing the share price of DLF. These include:

- Government Policies: Recent government initiatives aimed at boosting the housing sector, including tax incentives, have positively impacted the share price.

- Market Trends: A steady increase in demand for residential properties, particularly in urban centers, has contributed to investor confidence.

- Global Economic Factors: The current economic climate, including interest rates and inflation, also affects stock performance.

Future Outlook

Looking ahead, market analysts expect that the DLF share price could continue to rise, especially if the company maintains its growth trajectory and capitalizes on the increasing demand for housing. However, the real estate market remains sensitive to economic fluctuations and regulatory changes. Analysts recommend keeping an eye on upcoming policy announcements that could impact real estate investment, as well as broader economic indicators.

Conclusion

In conclusion, the DLF share price remains a vital indicator of the health of the Indian real estate market. For investors considering entering this market, understanding the factors driving share price changes is essential. With ongoing positive developments within the company and a favorable market environment, the DLF share price is likely to continue attracting attention from both retail and institutional investors. Staying informed and adapting to market changes will be key for anyone looking to benefit from investing in DLF shares.