Upcoming IPOs in India: What Investors Should Know

Introduction

The world of finance is buzzing with excitement as several companies prepare for their upcoming Initial Public Offerings (IPOs). These events are critical not only for the companies involved but also for investors looking to make informed decisions in a dynamic market. With an array of sectors represented, the upcoming IPOs are set to attract significant attention, allowing companies to raise capital for expansion while offering investors opportunities to partake in their growth.

Key Upcoming IPOs

As of October 2023, notable companies preparing for their IPOs include:

- XYZ Tech Solutions: Known for its innovative products in AI and machine learning, XYZ Tech Solutions has set a target of raising ₹1,500 crores. The company plans to use the funds for R&D and expanding its market reach.

- ABCD Pharmaceuticals: This pharmaceutical giant aims to raise ₹2,000 crores to strengthen its product pipeline and enhance its manufacturing capabilities. Investors are optimistic about its potential, given the growing demand for healthcare solutions.

- EFG Logistics: With e-commerce booming, EFG Logistics is set to launch its IPO planning to raise ₹800 crores, facilitating further investments in technology and infrastructure to improve its service efficiency.

Market Trends and Investor Insights

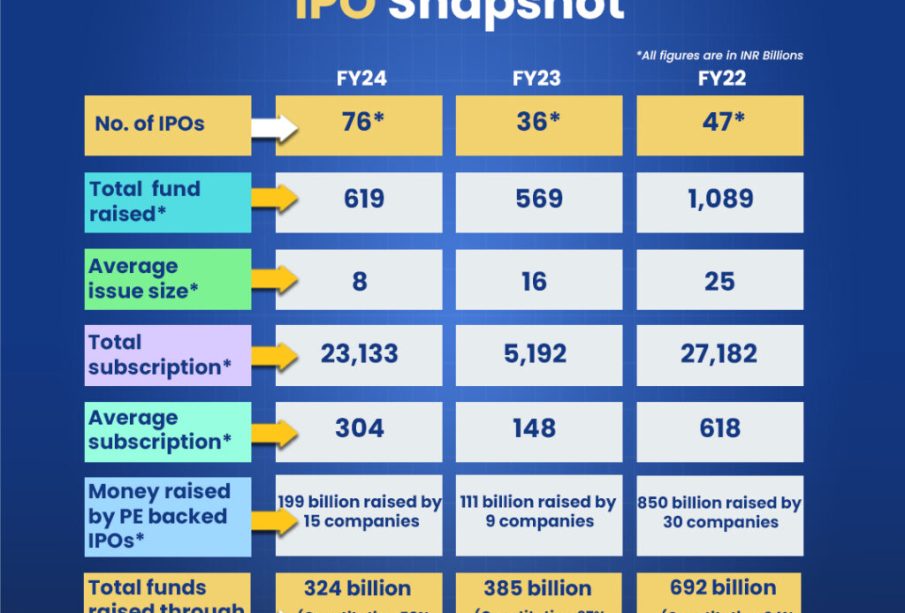

The upcoming IPOs reflect a broader trend in the Indian markets, where there has been an increase in companies transitioning to public listings. According to data from SEBI, 2023 has already seen a significant uptick in successful IPOs, fueled by favorable market conditions and investor sentiment. Analysts suggest that this activity will continue, driven by the post-pandemic recovery and government initiatives to promote entrepreneurship.

Experts recommend that potential investors conduct thorough research, analyzing companies’ business models, growth prospects, and financial health before making investment decisions. Additionally, it’s essential to consider the overall market environment, as IPO performance can be influenced by external economic factors.

Conclusion: The Road Ahead

As we move toward the end of the year, the upcoming IPOs in India present various opportunities for investors. With several major companies looking to enter the public market, the next few months could significantly impact the investment landscape. Investors should remain vigilant, leveraging the information available to make well-informed choices that align with their financial goals and risk appetite. The increasing trend of IPOs suggests a vibrant market ahead, with potential for significant returns for those willing to engage with the evolving environment.