HFCL Share Price: Analyzing Recent Trends and Market Impact

Introduction

The share price of HFCL Ltd., a leading telecommunications equipment manufacturer, plays a crucial role in the investment landscape of the Indian stock market. As a key player in the sector, the fluctuations in HFCL’s share price reflect not only the company’s performance but also the overall health of the telecommunications industry in India. With the rise of digital connectivity and the ongoing expansion of broadband services, investors and market analysts are keenly monitoring HFCL’s market position and share price trajectory.

Recent Performance of HFCL Shares

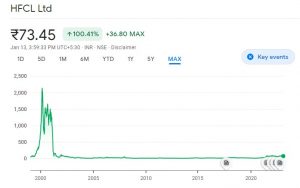

As of October 2023, HFCL’s share price has seen significant volatility. The shares traded at around ₹90 in early September, showing a steady increase due to positive financial results and growth prospects. By mid-October, the price peaked at ₹120, pushed upward by robust quarterly earnings reports and strategic partnerships aimed at expanding its 5G and optical fiber capabilities. However, following some profit booking, the shares have settled around ₹110, reflecting caution from investors amid global market uncertainties.

Key Developments Influencing HFCL’s Share Price

Several factors are contributing to the current trends in HFCL’s share price:

- Industry Growth: The demand for high-speed internet and 5G technology in India is skyrocketing, with the government backing significant infrastructure upgrades. HFCL, being a foundational player in this space, is benefiting from these developments.

- Partnerships and Contracts: Recently, HFCL secured contracts with various state governments to supply critical telecommunications solutions, ensuring a steady revenue stream.

- Market Sentiment: Broader market trends and investor sentiment significantly impact HFCL’s share price. With increasing interest in technology stocks post-pandemic, HFCL remains attractive to many institutional and retail investors.

Conclusion

The share price of HFCL Ltd. is an important indicator of its potential for investors, underpinned by industry growth and strategic initiatives. Looking forward, market analysts predict that as the telecommunications sector consolidates and expands, HFCL’s share price may continue to trend upward, albeit with potential short-term fluctuations. As such, it remains crucial for investors to keep a close watch on HFCL’s developments and broader market conditions when making investment decisions. Given the sector’s promising outlook, HFCL’s shares could represent a valuable opportunity for savvy investors in the coming months.