Current Trends in IDBI Share Price

Introduction

The IDBI Bank, one of the prominent private sector banks in India, has been making waves in the stock market lately. The share price of IDBI is crucial for investors and stakeholders, as it reflects the bank’s financial health and market perception. The performance of IDBI shares can influence broader market trends and investor confidence in the financial sector.

Recent Performance of IDBI Share Price

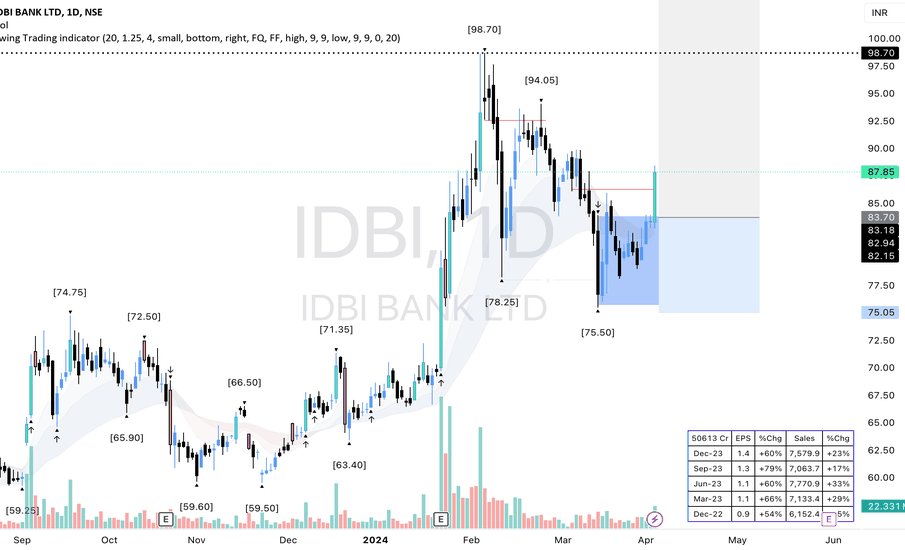

As of October 27, 2023, the IDBI share price has shown a significant upward trajectory. It opened at ₹47.50 and closed at ₹49.00, marking an increase of approximately 3.15% from the previous trading session. This positive trend can be attributed to the bank’s recent financial results, which showcased a robust year-on-year growth in net profit by over 25% for Q2 FY23-24.

Investor interest has surged following the announcement of initiatives aimed at asset quality improvement and a focus on retail banking, which is expected to yield long-term benefits. Furthermore, institutional buying has also provided support to the stock, with foreign institutional investors (FIIs) increasing their stakes in the bank.

Factors Influencing IDBI Share Price

Several factors are currently influencing the IDBI share price. The bank’s improving financial metrics, including a reduced gross non-performing assets (GNPA) ratio of 6.57% and a capital adequacy ratio (CAR) of 16.57%, are seen as positive signs by analysts. Additionally, the overall sentiment in the banking sector, buoyed by favorable economic policies and a burgeoning lending environment, continues to attract investors.

Moreover, the ongoing reforms in the banking sector and the government’s support through various financial schemes have instilled confidence among shareholders. The upcoming quarterly results will be pivotal in determining future price action, as investors will closely evaluate the bank’s sustainability in its growth trajectory.

Conclusion

The IDBI share price is currently in a growth phase with positive indicators suggesting a bright future for the bank. For investors, keeping an eye on economic trends, quarterly results, and sector health will be crucial in making informed decisions. The ongoing performance of IDBI shares will serve as an important barometer for the banking sector, and the coming months could provide more opportunities for investors looking to capitalize on this upward trend.