Current Trends in DLF Share Price

Introduction

The share price of DLF Limited, one of India’s leading real estate developers, is a topic of significant interest among investors and market analysts. Understanding the fluctuations in DLF’s share price is crucial not only for current shareholders but also for potential investors looking to enter the market. As the real estate sector recovers post-COVID-19, DLF’s performance reflects broader economic trends impacting this vital industry.

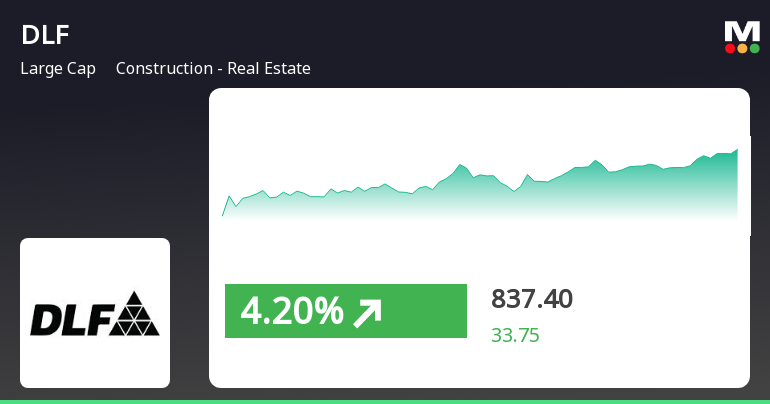

Current Performance

As of October 2023, DLF shares are trading at approximately INR 400 per share, reflecting a year-to-date increase of nearly 25%. This growth can be attributed to various factors, including strong quarterly financial results, strategic launches of new residential and commercial projects, and increasing demand in the real estate sector. Analysts suggest that the stock has the potential for further growth, driven by ongoing urbanization and a favorable interest rate environment that has revived home buying.

Market Analysis

DLF’s robust performance is bolstered by its diverse portfolio, which includes residential apartments, shopping malls, and office spaces. The company reported a net profit increase of 15% in the last quarter, signaling strong operational performance. Moreover, the government’s focus on affordable housing and urban infrastructure development has created an optimistic landscape for real estate companies like DLF. Real estate analysts expect DLF to maintain its growth trajectory, primarily due to its well-positioned projects in high-demand regions.

Conclusion

The current dynamics around DLF’s share price underscore a potentially lucrative opportunity for investors. However, potential investors should consider market volatility and conduct thorough research before making any investment decisions. Looking ahead, experts believe that with ongoing economic recovery and infrastructure initiatives by the government, DLF’s share price may continue to trend positively. Therefore, monitoring market trends and company performance will be vital for stakeholders in the coming months.