Current Trends in Yes Bank Share Price: An Overview

Introduction

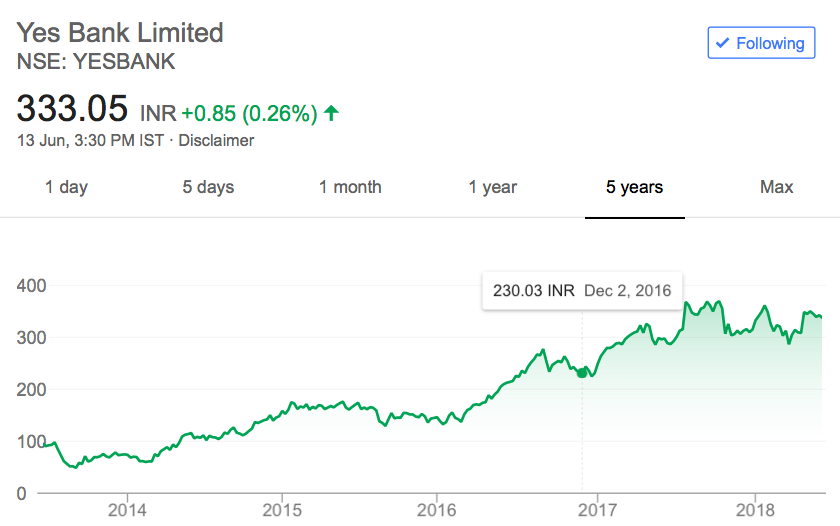

Yes Bank, one of India’s leading private sector banks, has been a topic of considerable interest among investors, especially concerning its share price movements in recent times. The importance of tracking the Yes Bank share price cannot be overlooked, as it not only reflects investor sentiment but also signals the bank’s financial health and operational efficiency. With various developments in the banking sector and economic landscape, understanding current trends in Yes Bank’s share price is imperative for stakeholders.

Recent Developments and Share Price Performance

As of October 2023, Yes Bank’s share price has shown remarkable resilience amidst market fluctuations. Last week, shares traded around INR 15.50, marking a significant increase from its earlier prices in the preceding months. The recent surge can be attributed to the bank’s reporting of improved quarterly results, which showcased a growth in net profit driven by a reduction in bad loans and an increase in net interest income.

On October 10, 2023, the bank announced its Q2 FY24 results, revealing a 75% increase in net profit compared to the same quarter last year. This announcement caused the share price to experience upward momentum, reflecting a positive outlook among investors. Additionally, the management’s commentary regarding future growth strategies and digital initiatives has also captured the interest of the investment community.

Market Conditions and Expert Opinions

The banking sector in India has seen a general upward trend, supported by the economy’s recovery post-pandemic. In this context, Yes Bank is often analyzed alongside its peers, like HDFC Bank and ICICI Bank, which also exhibit positive growth patterns. Analysts are optimistic, with several suggesting that the share price of Yes Bank could see further appreciation if the bank continues on its path of financial restructuring and digital enhancement.

However, investors are reminded to exercise caution, given that market volatility can impact stock performance. It is essential to monitor macroeconomic factors, policy changes, and regulatory announcements that could influence share prices across the sector.

Conclusion

In conclusion, Yes Bank’s share price is currently positioned at an interesting juncture with its recent financial performance garnering investor attention. As the market adapts to ongoing changes, the forthcoming quarters will be critical for the bank’s trajectory. Investors are advised to keep a close watch on future announcements and market trends to make informed decisions regarding their investments in Yes Bank shares. With its renewed focus on growth and customer service, the bank is poised for potentially robust developments in the coming months.