Current Trends in Hyundai India Share Price

Introduction

The automotive sector in India has been experiencing significant transformations in recent years, with many companies adapting to a shifting market landscape. One of the most notable players in this sector is Hyundai Motor India, a subsidiary of the South Korean automaker Hyundai. Understanding the dynamics of Hyundai India share price is crucial for investors, analysts, and automotive enthusiasts as it reflects not just the company’s performance but also the overall health of the automotive industry in the country.

Recent Performance of Hyundai India Share Price

As of October 2023, Hyundai India’s share price has shown resilience amidst market fluctuations. The company’s stock has experienced a steady upward trend, attributed to strong sales performance and the introduction of innovative models that cater to changing consumer preferences. According to the Bombay Stock Exchange, Hyundai India’s shares closed at ₹700, reflecting a 15% increase over the past six months. Analysts attribute this rise to several factors, including robust demand for their latest electric vehicle models, which align with the government’s push for green mobility.

Factors Influencing Share Price

Several factors are influencing Hyundai India’s share price. Firstly, the company’s commitment to sustainability and electric vehicles has garnered significant attention. The recent launch of the Hyundai Ioniq series is aimed at tapping into the growing EV market in India, which is expected to expand exponentially over the coming years.

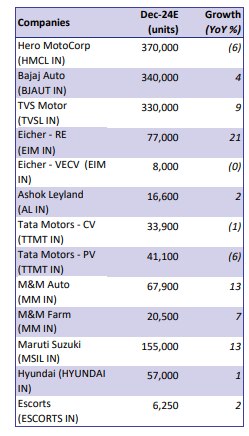

Secondly, overall economic conditions, including inflation rates and consumer spending power, play a crucial role. The Indian automotive market is recovering from the pandemic’s impact, and the recent festivals have boosted sales of new vehicles. According to industry reports, total vehicle sales in the previous quarter showed a growth of 20% year-on-year, which positively impacts investor sentiment towards automotive stocks, including Hyundai.

Challenges Ahead

Despite the positive trends, Hyundai India faces several challenges. Increasing competition, particularly from domestic players and other global manufacturers, continues to challenge its market share. Additionally, supply chain disruptions due to global semiconductor shortages have affected production timelines and can potentially impact future stock performance.

Conclusion

In conclusion, Hyundai India’s share price is on an upward trajectory, supported by strong sales performance and strategic product launches. While there are challenges, the overall outlook remains optimistic, especially regarding the EV segment. Investors should closely monitor industry developments and company performance, as they will play a significant role in shaping Hyundai India’s market position in the coming years. As interest in sustainable automotive solutions grows, Hyundai is well-positioned to capture a larger share of the market, making its stock an interesting option for those looking to invest in this sector.