Analysis of Concor Share Price Trends in 2023

Introduction

The India-based logistics giant, Container Corporation of India (Concor), plays a vital role in the country’s transportation and logistics sector. Regular tracking of its share price is crucial for investors, analysts, and market enthusiasts alike. The fluctuations in Concor’s share price are influenced by various factors including market dynamics, government policies, and the overall economic environment. As India strives to enhance its infrastructure and logistics capabilities, Concor’s performance will be significant for stakeholders.

Current Share Price and Market Performance

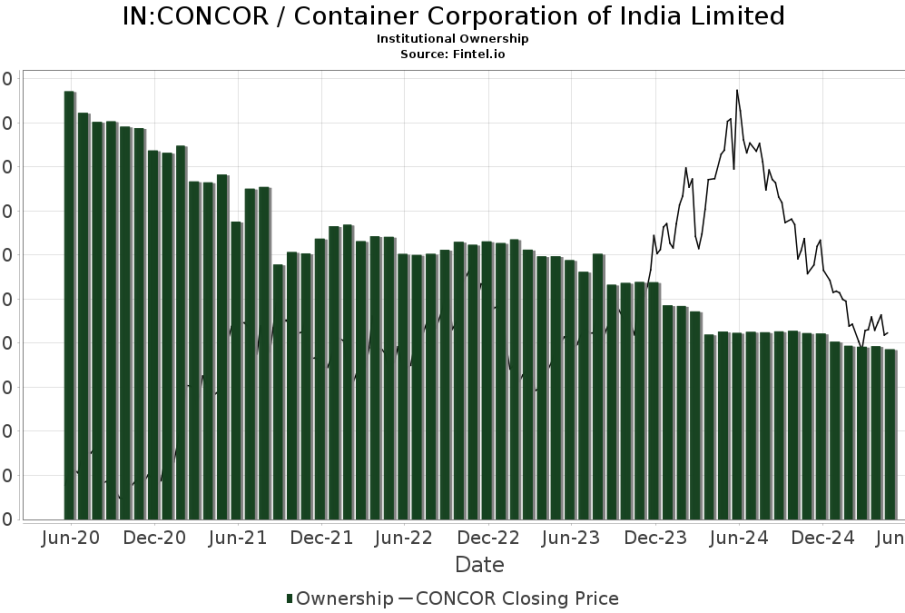

As of mid-October 2023, the Concor share price is observed at approximately ₹800 per share, having experienced a steady rise from earlier levels of ₹750 just a month ago. The increase in share price can be attributed to several factors: improved operational efficiencies, a strategic focus on expanding container terminals, and strong government support for freight and logistics sectors. Analysts have noted that the stock has been buoyed by positive quarterly results reflecting increased revenues and profitability.

Factors Influencing the Share Price

1. **Government Initiatives**: The Indian government’s emphasis on enhancing the logistics infrastructure through schemes such as the PM Gati Shakti National Master Plan has yielded promising outcomes for logistics companies including Concor.

2. **Economic Developments**: With the revival of economic activities post-pandemic, there has been a significant increase in import and export volumes which contributes positively to Concor’s revenue.

3. **Competition and Industry Dynamics**: Concor faces increasing competition from private players entering the logistics market. However, its established market position and extensive network across India provide it a competitive edge.

Future Forecasts and Implications

Market analysts remain optimistic about Concor’s future performance, predicting that if the current trends continue, the share price could reach ₹900 by year-end. Factors such as further investment in technology, expansion of freight services, and collaborations with private sectors could enhance profitability. Moreover, increasing focus on sustainability and environmental practices could lead to favorable governmental policies, which would also benefit Concor.

Conclusion

The Concor share price is a reflection of its robust positioning in the logistics sector and consistent alignment with national goals for infrastructure improvement. For investors, monitoring these trends and understanding market drivers will be key to making informed financial decisions. With potential growth anticipated in the coming months, Concor remains an appealing option for both short-term and long-term investors.