Current Trends in Mazgaon Dockyard Share Price

Importance of Monitoring Share Prices

The share prices of publicly traded companies provide valuable insights into their financial health and market perception. For investors and market analysts, understanding trends in share prices is crucial for making informed decisions. This is particularly relevant for organizations like Mazgaon Dockyard Limited, a recognized player in the defense and shipbuilding sector in India.

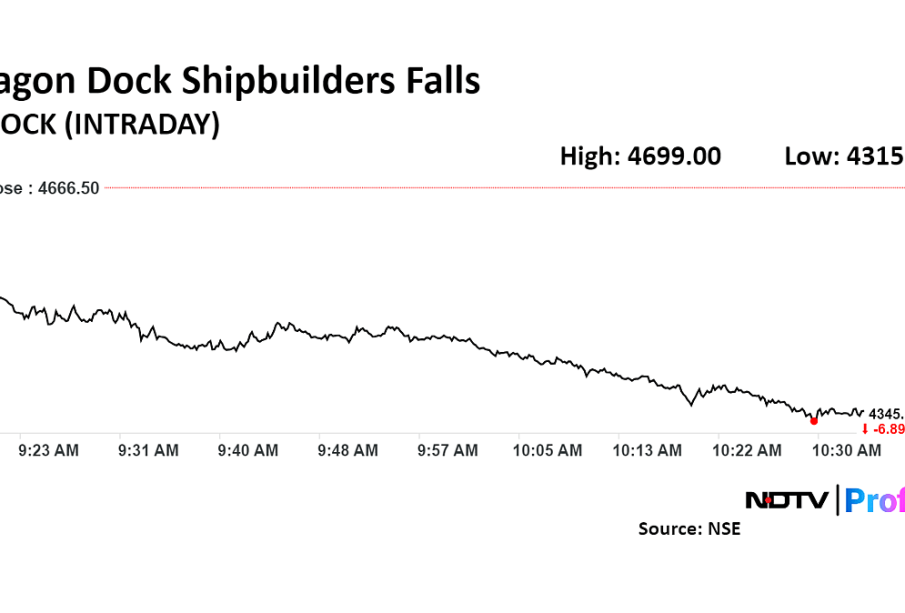

Current Share Price Trends

As of the most recent trading session on the Bombay Stock Exchange, Mazgaon Dockyard’s share price is noted at INR 309.50, reflecting a slight increase from the previous closing of INR 306.75. Observers note that the stock has shown a remarkable growth trajectory over the past few months, increased by approximately 15% since the start of the fiscal year. This uptrend can be attributed to heightened demand for defense materials and shipbuilding, aligning with government initiatives aimed at boosting the domestic defense manufacturing industry.

Factors Influencing the Share Price

The fluctuation in the share price of Mazgaon Dockyard can be attributed to several factors. Firstly, the increase in defense expenditures by the Government of India, with a focus on indigenous production capabilities, has significantly strengthened investor confidence. Furthermore, recent contracts secured by the company for the construction of naval ships and submarines have also boosted its market standing.

Additionally, analysts expect Mazgaon Dockyard to continue benefiting from the ‘Atmanirbhar Bharat’ (Self-Reliant India) initiative, aimed at making India self-sufficient in various sectors including defense. Moreover, the integration of advanced technologies in shipbuilding practices is likely to enhance productivity, thereby positively influencing future share prices.

Investor Sentiment and Future Outlook

Investor sentiment towards Mazgaon Dockyard remains positive, with many analysts issuing optimistic forecasts based on thorough market analysis. Investment banks and financial advisors recommend staying bullish on the stock, given the strategic importance of naval capabilities in India’s defense framework.

In conclusion, monitoring the Mazgaon Dockyard share price is essential for investors seeking to capitalize on the growth potential in the defense sector. As the company secures more contracts and the government continues to endorse local production, the outlook appears promising for both the stock and the industry at large. Investors are advised to remain updated with market news and consider long-term strategies for optimal gains.