Cochin Shipyard Share Price: Latest Trends and Insights

Importance of Cochin Shipyard in the Market

Cochin Shipyard Limited (CSL), one of the leading shipbuilding companies in India, plays a vital role in the maritime industry by constructing ships and vessels for various purposes, including defense and commercial use. Given its significance, understanding the fluctuations in Cochin Shipyard’s share price is essential for investors and market analysts alike.

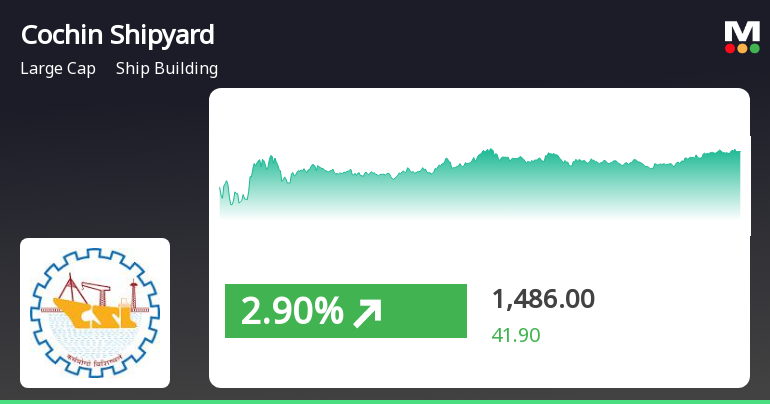

Recent Price Movements

As of October 2023, Cochin Shipyard’s share price has experienced notable fluctuations. In the past month, shares have moved within a range of INR 430 to INR 460, reflecting varying investor sentiments, market trends, and company announcements. Analysts attribute these changes partly to the increase in defense infrastructure investments by the Government of India, which has led to a positive outlook on shipbuilding sectors like Cochin Shipyard.

Factors Influencing Share Price

Several factors influence the share price of Cochin Shipyard:

- Government Initiatives: The Indian government’s push for ‘Make in India’ and increased defense procurement budgets often boosts CSL’s growth potential.

- Quarterly Performance: Recent quarterly earnings reports have shown a steady increase in revenue and profit margins, which positively impact investor confidence.

- Global Market Trends: Changes in the global shipping industry, including demand for marine vessels and competition from other shipyards, also affect the share price.

Market Predictions

Looking ahead, market analysts have mixed forecasts regarding the Cochin Shipyard share price. Some predict a continued upward trend due to the anticipated increase in defense contracts and advancements in eco-friendly ships, which are expected to rise in demand in the coming years. Others suggest caution, highlighting potential volatility due to global economic uncertainties.

Conclusion

Investing in Cochin Shipyard shares may yield profitable opportunities, but it is crucial for investors to remain informed of market conditions and company performance indicators. As always, conducting thorough research and seeking financial advice is recommended before making investment decisions. The ongoing developments in the maritime sector indicate that Cochin Shipyard will remain a significant player, and its share price will continue to be a focal point for investors.