Recent Trends in Page Industries Share Price

Introduction

The share price of Page Industries, which has been a cornerstone in the Indian apparel sector as the exclusive licensee of Jockey International, is currently a focal point for investors. As of October 2023, understanding the fluctuations and trends in Page Industries’ share price is critical for both existing shareholders and potential investors, given its impact on the company’s market valuation and investor sentiment.

Current Share Price Analysis

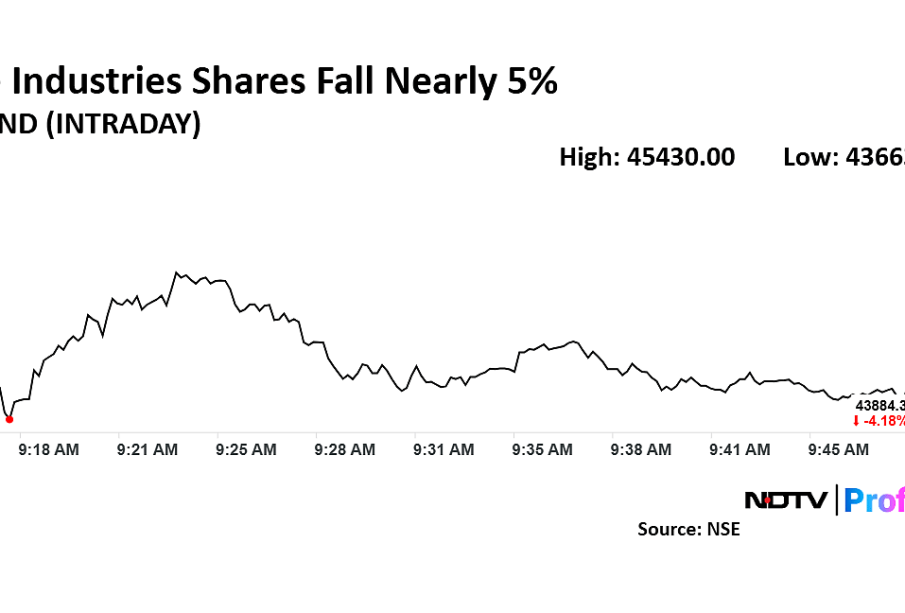

As per the latest reports, Page Industries’ share price has experienced notable volatility in recent weeks. As of the last trading session, the stock was priced at ₹39,000, reflecting an increase of approximately 10% since the beginning of the month. This uptrend has been attributed to strong quarterly results and positive consumer demand signals in the apparel sector.

Analysts observe that the company’s robust distribution channels and innovative marketing strategies have played a crucial role in driving sales. Furthermore, with the onset of the festive season, there is speculation about further growth, and industry experts believe that Page Industries can sustain momentum.

Factors Influencing Share Price

Several factors are contributing to the share price dynamics of Page Industries. Among these is the overall performance of the Indian textile market, which has seen a resurgence post-pandemic, as consumer spending on apparel rebounds. Additionally, the strategic expansions and product diversification initiatives undertaken by the company have bolstered investor confidence.

Foreign Direct Investment (FDI) policies in retail and e-commerce reforms also play a significant role in shaping the competitive landscape, which in turn affects the stock performance of Page Industries. The company’s strong financial fundamentals, including a healthy debt-equity ratio and solid cash reserves, make it an attractive option for investors looking for stability amid market fluctuations.

Forecast and Future Outlook

Looking ahead, the forecast for Page Industries’ share price remains optimistic, with financial analysts projecting a potential rise influenced by expanding market share and new product launches. The stock could see support around the ₹37,000 mark, with an upward resistance anticipated at ₹40,500 in the near future, contingent on global market conditions and consumer trends.

Conclusion

In conclusion, the fluctuating share price of Page Industries signifies much more than just numbers—it reflects the broader economic climate and consumer behavior in India. For current and potential investors, keeping an eye on market trends, consumer trends, and the company’s strategic initiatives is crucial in making informed investment decisions. As Page Industries continues to evolve, its performance will remain integral to understanding the future of the Indian apparel industry.