Current Trends in Raymond Share Prices

Introduction

The share market serves as a vital indicator of a company’s performance and investor sentiment. Raymond Ltd., a renowned Indian multinational in textiles and apparel, has recently come under the spotlight as investors are keenly observing its share price movements. This is especially significant due to the rapidly changing dynamics of the fashion industry, recent company strategies, and broader economic factors influencing the markets.

Raymond Ltd.: Company Overview

Founded in 1925, Raymond Ltd. has established itself as a pioneer in the textiles sector in India. The company is famed for its high-quality fabrics and has diversified into various segments, including ready-to-wear garments, premium fabrics, and home textiles. It operates several brands and has a vast retail network across the country, making it a household name.

Current Share Price Dynamics

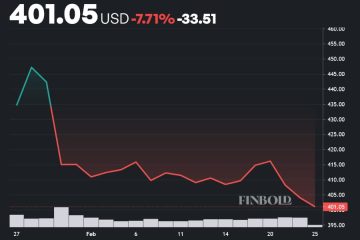

As of October 2023, Raymond’s share price is showing signs of volatility, reflecting broader market trends and specific company developments. According to the National Stock Exchange, the share price has fluctuated between INR 1,350 to INR 1,450 over the past month, influenced by several factors including quarterly earnings reports, raw material prices, and consumer demand dynamics.

The company recently reported a 15% increase in revenue for Q2 2023, attributed to higher demand in the apparel segment. This positive performance is encouraging for investors. Moreover, industry analysts project that the textile sector will continue to grow, particularly as global markets recover and demand for fashion products rises.

Future Outlook

Looking ahead, analysts suggest that investments in Raymond shares could be promising, particularly if the company continues to innovate and expand its product offerings. The firm’s commitment to sustainability and strategic partnerships could also open new revenue streams. However, investors are advised to keep an eye on global economic conditions that may affect textile exports and consumer spending patterns.

Conclusion

The fluctuations in Raymond’s share prices underscore the importance of staying informed about not just the company itself, but also the broader market trends impacting investor confidence. As the company navigates through challenges and opportunities in the textile industry, its share price performance will likely reflect its ability to adapt and thrive. Investors and market watchers should remain vigilant and consider both market analytics and company developments when evaluating Raymond shares.