Upl Share Price: Trends and Insights for Investors

Importance of Upl Share Price

The UPL Limited share price is a crucial metric for investors and market analysts, offering insights into the financial health and market perception of one of India’s leading agrochemical companies. Understanding the fluctuations in UPL’s share price can help stakeholders make informed investment decisions.

Recent Trends and Movements

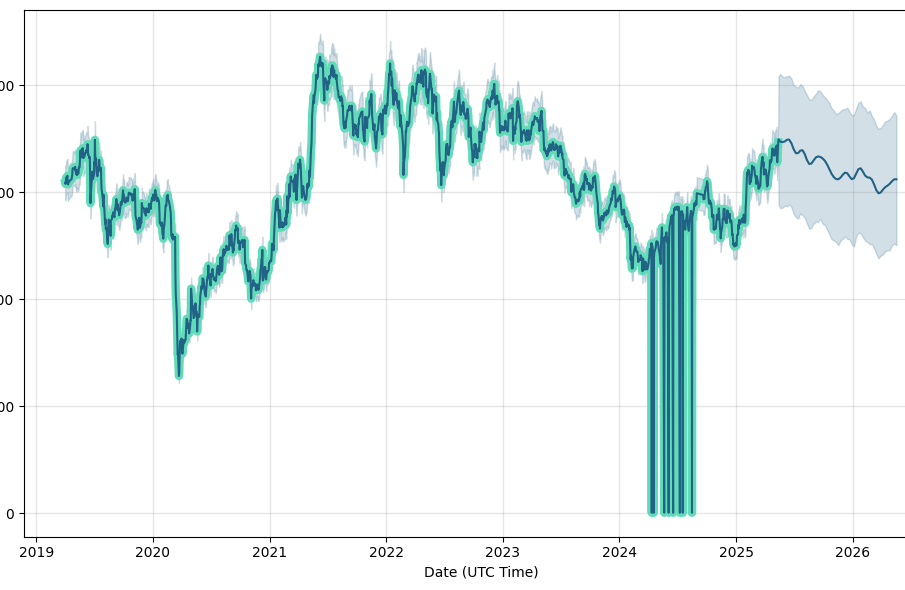

As of late October 2023, UPL’s share price has seen notable volatility, reflecting broader market trends and sector-specific developments. The stock opened at approximately ₹890 but has experienced considerable ups and downs since then. Analysts attribute these movements to several factors, including fluctuations in raw material prices, regulatory changes in agriculture policies, and the global demand for agrochemicals.

In a recent conference call, UPL’s CEO, Mr. Jai Shroff, indicated confidence in the company’s growth strategy, particularly in expanding its footprint in growing markets and enhancing its product offerings. This has been reflected positively in analysts’ forecasts, with many suggesting a moderate increase in the company’s share price over the next fiscal year.

Driving Factors Behind Share Price Fluctuations

Several factors are influencing the recent movements in UPL’s share price. Firstly, the company’s robust earnings report for Q2 FY2024, which showcased a 15% increase in revenue year-over-year, has driven a positive sentiment among investors. Additionally, UPL’s strategic acquisitions and investments in sustainable farming practices are seen as crucial long-term growth drivers. However, fluctuations in global commodity prices and potential impacts from climate change remain significant risks that could affect future performance.

Conclusion and Future Outlook

In conclusion, while the UPL share price has shown volatility recently, the company’s solid fundamentals and strategic initiatives paint a promising picture for the future. Investors should keep an eye on market trends and UPL’s operational developments to make informed decisions regarding their investments. With analysts projecting a potential recovery in the share price as the agrochemical sector rebounds, UPL remains a noteworthy candidate for long-term investment in the agricultural sector.