Latest Updates on ICICI Bank Share Price

Introduction

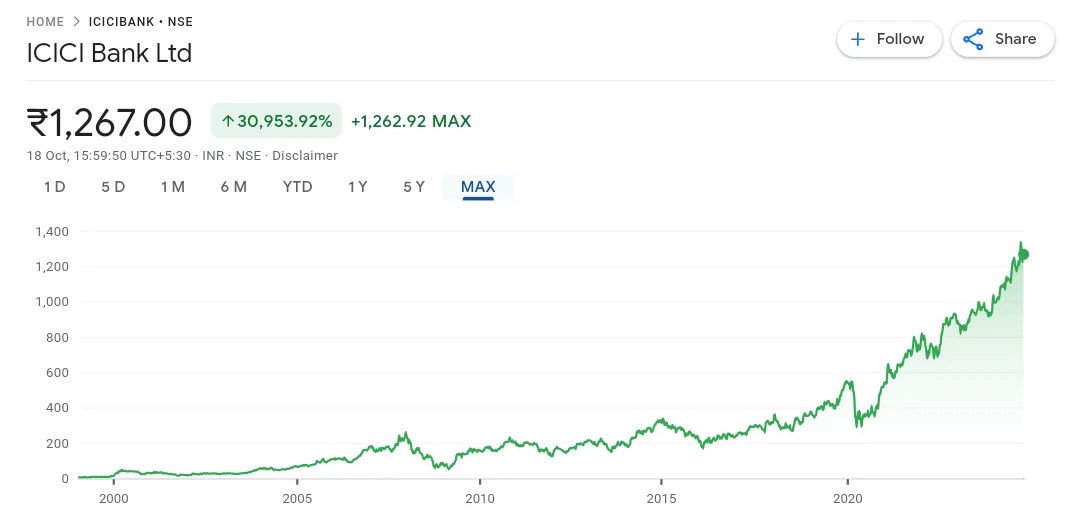

The ICICI Bank share price has been a topic of significant interest for investors in the Indian stock market. As one of the largest private sector banks in India, ICICI Bank plays a crucial role in the economy and its stock performance is closely watched by analysts and investors alike.

Current Share Price Trends

As of the latest trading session, ICICI Bank’s share price is trading at approximately ₹900, showing a slight increase of 1.5% from the previous day. The bank’s stock has seen a steady upward trend over the past month, climbing nearly 8%, fueled by strong quarterly results and positive market sentiment regarding the financial sector.

Factors Influencing the Share Price

Several factors have contributed to the current share price of ICICI Bank:

- Quarterly Earnings: The bank’s latest earnings report indicated a robust growth of 15% in net profit, reaching ₹7,000 crores, which exceeded analysts’ expectations.

- Economic Recovery: As the Indian economy continues to recover from the pandemic, the banking sector, including ICICI Bank, is benefiting from increased lending and lower bad loan ratios.

- Future Prospects: Analysts have a positive outlook on ICICI Bank, with many projecting further growth driven by expansion strategies and digital banking initiatives.

Investor Sentiment

Market analysts suggest that investor sentiment remains bullish due to the bank’s strong asset quality and consistent return on equity. Institutional investors are increasingly accumulating shares, reflecting confidence in the bank’s management and strategy moving forward.

Conclusion

In conclusion, the ICICI Bank share price is currently performing well, reflecting strong fundamentals and positive market dynamics. Investors are advised to keep an eye on the upcoming quarterly results and economic indicators that could further influence the bank’s share performance. As always, thorough research and consideration of market conditions are essential for making informed investment decisions.