Current Trends in JSW Steel Share Price

Introduction

JSW Steel, one of India’s leading manufacturers of steel, has been a significant player in the stock market. Its share price is closely monitored by investors and market analysts due to the company’s substantial role in the steel production sector, which is vital for the country’s infrastructure development and economic growth. As of October 2023, understanding the trends in JSW Steel’s share price is crucial for investors looking to make informed decisions.

Latest Developments

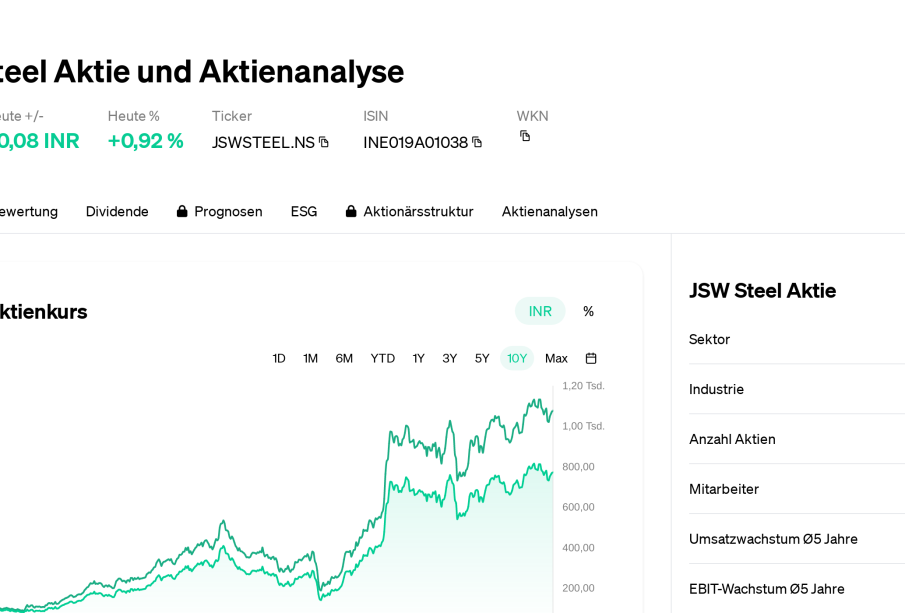

As of mid-October 2023, JSW Steel’s share price has shown noteworthy fluctuations influenced by various factors. On October 10, the share price reached approximately ₹780, reflecting a recovery from previous dips that had stirred concerns among investors.

Recent reports indicate that the demand for steel in India is expected to rise due to government initiatives aimed at boosting infrastructure spending. The Union Budget 2023-24 has allocated substantial funds towards infrastructure projects, which could potentially enhance the demand for steel products, thereby positively impacting JSW Steel’s market performance.

Factors Influencing Share Price

Several elements contribute to the fluctuation of JSW Steel’s share price:

- Raw Material Prices: Changes in the prices of iron ore and coke, the main raw materials for steel production, significantly affect profitability and share price.

- Global Market Trends: International steel prices and global demand trends play a crucial role in domestic pricing and market performance.

- Company Performance: Quarterly financial results showcasing production capacity, sales growth, and profit margins contribute to investor sentiment.

- Regulatory Changes: Policies affecting the steel sector, including environmental regulations and import duties, can have immediate impacts on share performance.

Current Share Price Analysis

Technical analysis suggests that JSW Steel’s stock is maintaining a bullish trend, with moving averages indicating a potential upward trajectory. Analysts have placed target prices in the range of ₹800-₹850 as the market reacts positively to the anticipated growth in the steel sector.

Conclusion

In summary, the JSW Steel share price remains an important metric for both investors and analysts. With expected growth in the infrastructure segment and favorable global trends, there is potential for a positive shift in its share price in the upcoming months. Investors should keep an eye on market trends, raw material prices, and company performance updates to make informed investment decisions.