Overview of IndusInd Bank Share Performance

Introduction

IndusInd Bank, a prominent private sector bank in India, has been at the forefront of the banking sector, providing various financial services and products. The performance of its shares has significant implications for investors, market analysts, and the broader economy, especially in the context of changing economic conditions. This article delves into the recent trends and performance of IndusInd Bank shares, analyzing their importance in the current market scenario.

Recent Performance

As of October 2023, IndusInd Bank’s shares have witnessed a volatile trading period primarily due to shifts in interest rates and economic policies impacting the banking sector. After a steady rise early in the year, where shares reached an all-time high of ₹1,265, there has been a slight correction, and shares are currently trading around ₹1,100. Analysts attribute this fluctuation to broader economic headwinds, including inflation and changes in regulatory frameworks.

Market Sentiment and Future Outlook

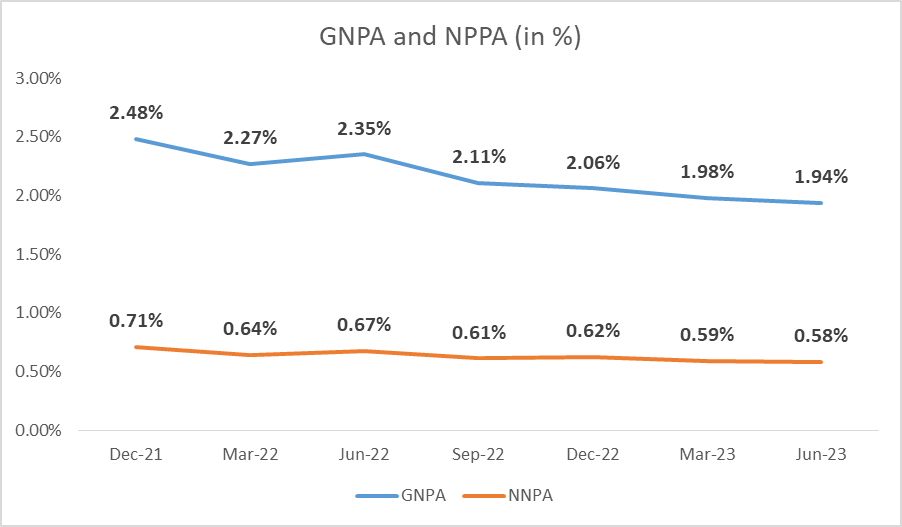

Investor sentiment around IndusInd Bank remains generally optimistic, even with recent fluctuations. Several analysts point to the bank’s strong asset quality and growth in its retail loan portfolio as positive signs. The bank has also consistently focused on expanding its digital initiatives, which is seen as a strategic move to attract a younger audience and enhance customer engagement.

According to a report from Kotak Institutional Equities, the bank’s net profit for the second quarter of FY2024 is projected to be robust, driven by growth in both volumes and margins. This expectation might lead to a resurgence in share prices as investors buy on dips. Additionally, the bank’s recent initiatives to increase its presence in Tier 2 and Tier 3 cities are likely to bolster its growth prospects further.

Conclusion

In conclusion, the shares of IndusInd Bank remain a noteworthy investment in the Indian banking sector. While recent volatility may cause concern among investors, the underlying fundamentals of the bank, along with its strategic initiatives, suggest a positive outlook. For potential investors, keeping an eye on macroeconomic indicators and the bank’s evolving strategy could pave the way for informed investment decisions. As the banking sector continues to adapt to changing economic landscapes, IndusInd Bank’s performance will be a crucial indicator of broader market trends.