Current Trends in Swiggy Share Price

Introduction

Swiggy, one of India’s largest food delivery platforms, has become a significant player in the technology and e-commerce sectors. As companies move towards a digital-first strategy, Swiggy’s performance in the stock market becomes crucial for investors and stakeholders in the food delivery ecosystem. With ongoing fluctuations in share prices, understanding the drivers behind these changes is essential for both existing and prospective investors.

Recent Performance and Events

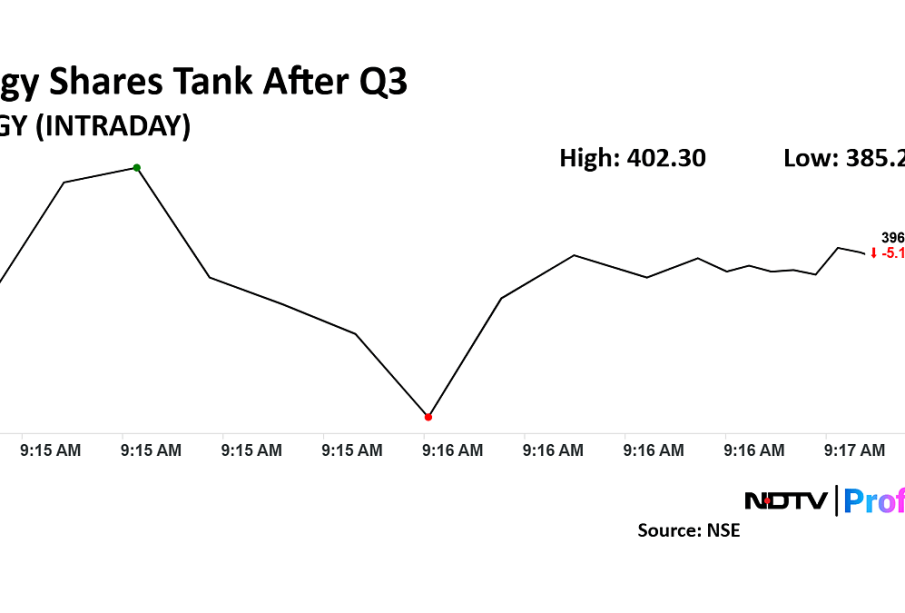

As of the latest trading sessions, Swiggy’s share price has witnessed considerable volatility. Recent reports indicate that shares were trading around ₹900, reflecting a drop of approximately 3% from the previous week. Experts attribute this change to various factors including shifts in consumer demand post-pandemic and increased competition from rivals such as Zomato and Amazon.

In addition, Swiggy’s initiatives to diversify its business, including expanding into grocery and quick commerce segments, have had mixed implications. The launch of Swiggy Instamart, aiming to deliver groceries in under 30 minutes, is seen as a strategic move. However, this diversification also brings financial pressures that can influence share price performance.

Market Analysis

Analysts at financial firms have varied outlooks on Swiggy’s future share performance. Some suggest a cautious perspective, correlating current share prices with the broader market trends and potential challenges in cost structures and profitability. Others are optimistic, citing the sustainable growth potential tied to digital payments and a robust consumer base.

Conclusion

In summary, Swiggy’s share price remains under close scrutiny due to the fast-evolving food tech landscape and changing consumer behaviors. Investors and market analysts should watch for updates on Swiggy’s financial performance in the upcoming earnings reports, as these will provide significant insights into future price movements. As Swiggy continues to innovate and expand its offerings, its share price will likely reflect the broader market trends and the company’s ability to adapt. The next quarter could prove pivotal in establishing a clearer trajectory for Swiggy’s stock as it navigates these dynamic market conditions.