Recent Trends in Zomato Shares: A Market Overview

Introduction

Zomato, one of India’s leading food delivery and restaurant aggregator platforms, has seen significant developments in its share price over the last few months. As a key player in the Indian startup ecosystem, Zomato’s performance in the stock market is crucial not just for investors but also for the broader perception of the Indian tech and food delivery sectors. Understanding how the Zomato share is faring provides insight into market reactions, investor sentiment, and the future of food tech in the country.

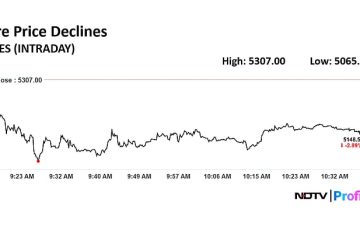

Current Market Performance

As of October 2023, Zomato’s shares have witnessed notable fluctuations, mirroring the volatility of the tech-driven stock market. After an impressive initial public offering (IPO) in July 2021, Zomato shares soared, peaking shortly after they became publicly traded. However, the subsequent months saw a correction, leading to declines attributed to various market factors including inflation and regulatory scrutiny on the sector. Most recently, Zomato shares closed at approximately INR 70, representing a 15% increase from a month earlier, thanks to positive earnings forecasts and an increase in consumer demand for online food delivery services.

Significant Developments

A key factor influencing Zomato’s share performance has been its strategic initiatives and expansions. The company reported a rise in gross order value (GOV) for the second quarter of FY2023, attributed to the surge in online dining and meal delivery preferences. Zomato’s investments in drone technology for delivery and its continuous efforts to enhance customer experience through various promotions are also solidifying its market position. In recent earnings reports, the firm announced reduced cash burn rates and a path to profitability which have positively swayed investor confidence.

Investor Sentiment

Investor sentiment towards Zomato shares appears cautiously optimistic. Analysts highlight the company’s robust business model and growing market presence, especially in Tier II and III cities where the digital adoption is accelerating. The growing inclination towards online food ordering post-pandemic has fostered a favorable environment for Zomato’s share to recover and potentially grow further. Nevertheless, uncertainties related to competition from rivals like Swiggy and regulatory challenges in the startup ecosystem remain risks that investors must consider.

Conclusion

In conclusion, as Zomato continues to refine its operational efficiencies and explore innovative strategies to drive growth, its shares remain a focal point for investors interested in the foodtech sector. While recent performances and forecasts appear positive, market watchers should remain vigilant about potential risks ahead. The trajectory of Zomato shares will be an important barometer for the overall health of the Indian tech stock market and the food delivery industry. Given the increasing consumer preference for digital services, Zomato is well-positioned to capitalize on emerging trends, making its shares a compelling prospect for long-term investors.