Latest Insights into Adani Power Share Performance

Importance of Adani Power Shares

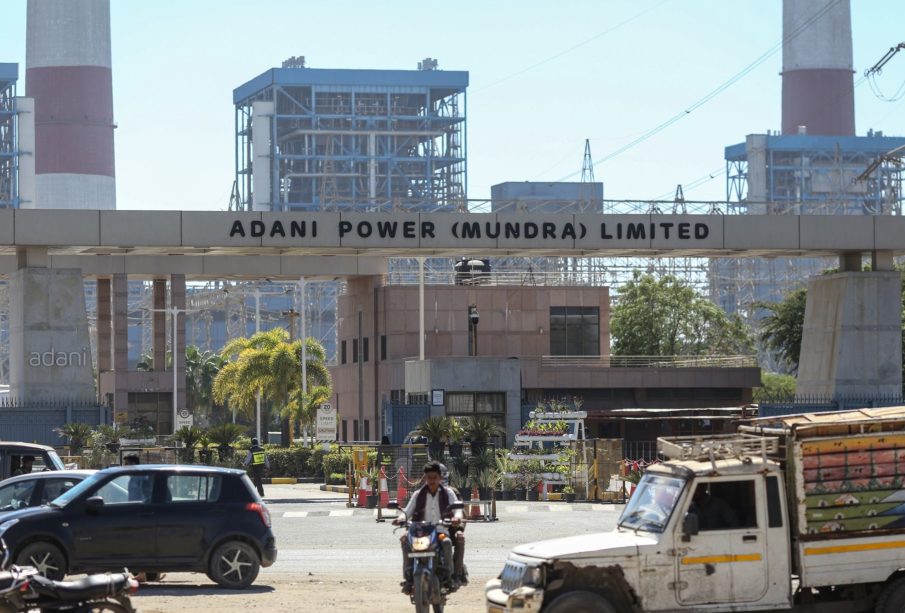

The performance of Adani Power shares has significant implications for investors and the energy sector in India. As one of the leading power producers in the country, Adani Power plays a crucial role in shaping the energy landscape. Following recent market trends, understanding the developments surrounding Adani Power shares is essential for making informed investment decisions.

Recent Market Movements

As of October 2023, Adani Power shares have experienced notable fluctuations amidst broader stock market patterns. After facing challenges earlier in the year, notably due to environmental and regulatory scrutiny, the shares began to regain momentum. In mid-October, the stock surged by approximately 10%, driven by positive announcements about their renewable energy projects, including substantial investments planned for solar and wind energy.

Strong quarterly reports revealing an increase in profit margins have further contributed to investor confidence. The company reported a 15% year-on-year growth in net profits, leading analysts to upgrade their forecasts for the stock’s price trajectory.

Market Implications

Analysts believe that Adani Power’s strategic shift towards renewable energy aligns well with India’s commitment to achieving a significant percentage of its energy needs from non-fossil sources by 2030. This could enhance the company’s market position, particularly in the light of changing government policies favoring sustainable energy solutions.

Moreover, the rising energy demand in India, paired with potential international collaborations in green technologies, could further elevate the value of Adani Power shares. Investor sentiments are optimistic, especially following comments from company executives regarding a robust pipeline of projects aimed at generating sustainable profits.

Conclusion and Future Outlook

In conclusion, Adani Power shares appear to be regaining their footing in the market, driven by strong financial performance and a strategic pivot towards renewable energy. The stock’s trajectory may continue to climb as investor confidence grows and structural changes within the energy sector unfold. It is crucial for potential and current investors to stay updated with ongoing developments, as the energy market evolves rapidly. Formulating a long-term investment strategy could potentially yield benefits in alignment with India’s renewable energy ambitions.