Latest Trends in Canara Bank Share Price

Introduction

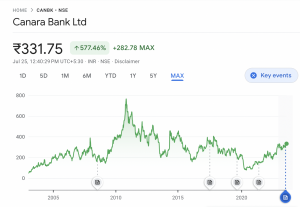

Canara Bank, one of the leading public sector banks in India, has been making headlines recently due to its fluctuating share prices. Monitoring the share price of such a significant financial institution is crucial not only for investors but also for those interested in the broader economic landscape. As the bank aligns its operations with the Reserve Bank of India’s directives and adapts to market dynamics, understanding the movement of its share price offers insights into investor sentiments and the bank’s overall performance.

Current Status of Canara Bank Share Price

As of late October 2023, the share price of Canara Bank has showed a notable increase of around 15% over the past month. This rise can be attributed to the bank’s robust financial results for the second quarter, which exceeded market expectations. The bank reported a net profit of ₹2,000 crores, indicating a year-on-year growth of 20%. Such results have stirred positive interest among investors, boosting share prices significantly.

Factors Influencing Share Price Movements

Several factors contribute to the fluctuations in Canara Bank’s share price. The bank has been focusing on enhancing its asset quality which includes improving its gross non-performing assets (GNPA) ratio. According to analysts, the GNPA ratio has decreased from 8% to 6% over the last year, reflecting effective management of loan books and recovery efforts. Furthermore, the bank’s strategic initiatives like expanding its retail loan portfolio and digital banking services have also positively influenced investor outlook.

Market Reaction and Future Outlook

The Indian stock market, especially amid global economic uncertainties, has been reactive to financial institutions’ performances. Canara Bank’s role in the government’s financial inclusion programs has also contributed to its solid performance. Analysts speculate that the share price will continue to grow if the bank maintains its current trajectory. Projections indicate that the share could reach ₹350 in the next quarter if the bank continues to perform well and external economic factors remain stable.

Conclusion

The share price of Canara Bank presents a significant opportunity for investors seeking long-term gains. Given the current bullish trend and the bank’s proactive measures to enhance its financial health, many believe that this is an optimistic period for Canara Bank. Investors are advised to keep an eye on quarterly results and market developments to make informed decisions regarding their investments in Canara Bank.