Current Trends in HFCL Share Price

Introduction

HFCL Limited, a leading telecommunications equipment manufacturer, has garnered significant attention on the Indian stock market due to its consistent performance and growth prospects. Understanding the HFCL share price is crucial for investors looking to make informed decisions in a rapidly evolving sector.

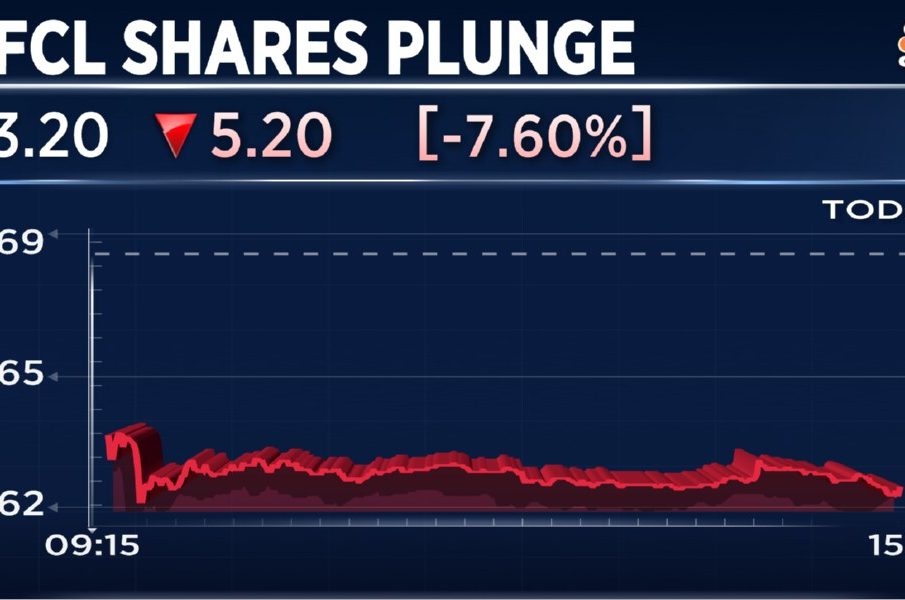

Current Performance of HFCL Shares

As of October 2023, HFCL’s share price is witnessing substantial fluctuations owing to various market dynamics. The company’s stock has recently been traded around INR 58, showcasing a growth of approximately 15% over the past month. Analysts attribute this rise to HFCL’s strong second-quarter earnings report, where the company announced a revenue growth of 25% year-on-year, driven by increased demand for its broadband and telecom infrastructure solutions.

Market Factors Influencing HFCL’s Share Price

Several factors are impacting the performance of HFCL shares. The government’s push for enhancing digital infrastructure in India, coupled with the rollout of 5G services, places HFCL in a favorable position to capitalize on these developments. The company’s strategic collaborations, such as partnerships with various telecom giants, have also bolstered investor confidence.

Moreover, the overall performance of the Indian stock market and global economic conditions play a significant role. Any adverse economic news can lead to volatility affecting HFCL’s share price. It is essential for investors to keep an eye on these broader market trends along with specific company activities.

Conclusion

In conclusion, the HFCL share price reflects not only the company’s performance but also the overall health of the telecommunications sector in India. As the demand for advanced network solutions continues to rise, HFCL remains a key player to watch. Investors should monitor quarterly results and market conditions to strategically engage with HFCL shares. With the ongoing advancements in technology and the government’s supportive policies, the future outlook for HFCL appears promising, but investors must remain vigilant of potential market fluctuations.