Understanding Eternal Share Price in Current Market Trends

Introduction

In today’s dynamic financial environment, the share price of companies plays a crucial role in investor decisions. One particular company, Eternal, has been making headlines recently due to its fluctuating share price. Understanding the factors that contribute to this volatility is essential for investors and stakeholders alike.

Recent Trends in Eternal Share Price

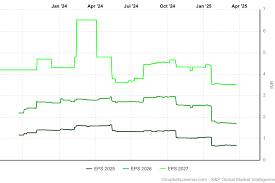

Eternal has seen significant fluctuations in its share price over the last few months, primarily driven by market sentiment and changing economic conditions. As of the latest financial reporting in October 2023, Eternal’s share price stands at ₹150, reflecting a 12% increase from its previous quarter, buoyed by better-than-expected earnings and strategic expansions into new markets.

Analysts attribute this growth to several key factors: enhanced product offerings, increased market penetration, and effective cost management strategies. Moreover, international partnerships have strengthened the company’s global presence, contributing positively to investor confidence.

Market Influences

External factors such as global economic trends, regulatory changes, and shifts in consumer behavior have also impacted Eternal’s share price. For instance, the recent policies promoting sustainable practices have positioned Eternal favorably among environmentally conscious investors. Additionally, the ongoing recovery from the pandemic has increased consumer spending, which has further propelled Eternal’s market performance.

Future Outlook

Looking ahead, analysts are optimistic about Eternal’s growth trajectory. The ongoing digital transformation and innovation initiatives are expected to enhance operational efficiency and drive further revenue growth. Forecasts suggest that the share price may reach between ₹160 to ₹180 in the next quarter, depending on market conditions and consumer demand.

Conclusion

In conclusion, the share price of Eternal is influenced by a combination of internal strategies and external market conditions. For investors, staying informed about these elements is key to making prudent investment decisions. As the company continues to evolve and adapt to changing market dynamics, its share price will reflect these developments, offering both opportunities and challenges to stakeholders.