Understanding Zomato Share Price Trends and Insights

Introduction

In recent years, Zomato has emerged as one of India’s leading online food delivery platforms. The company, which went public in July 2021, has attracted significant attention from investors and analysts alike, making its share price a focal point in the Indian stock market. Tracking the Zomato share price is crucial for investors looking to capitalize on the growing food-tech sector in India, particularly in the wake of the pandemic that fueled a surge in online food deliveries.

Recent Developments and Market Performance

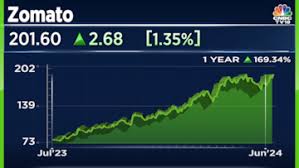

As of October 2023, Zomato’s shares have shown volatility, reflecting wider trends in the Indian stock market and specific challenges within the food delivery industry. After reaching a peak shortly after its IPO, the stock price faced corrections due to various factors, including increasing operational costs and intense competition from rivals like Swiggy and new entrants in the market. Notably, Zomato’s recent quarterly earnings report showed an improvement in revenue, which has positively influenced its share price.

Market analysts point out that Zomato has taken strategic steps to strengthen its position. This includes diversifying its services beyond food delivery, such as grocery deliveries through its acquisition of Blinkit. This diversification may help stabilize its share price in the long term as the company adapts to changing consumer behaviors.

Impact of Competition and Market Trends

Competition in the food delivery sector remains fierce, with companies constantly innovating to capture market share. This scenario affects Zomato’s stock, as investor sentiment often reacts to the company’s ability to maintain or grow its user base against competitors. Recent promotional offers and partnerships have been adopted to attract more customers, potentially leading to increased market revenue and, by extension, a more favorable share price.

Conclusion and Future Outlook

The outlook for Zomato’s share price remains cautiously optimistic. While investors should be prepared for fluctuations, the fundamentals of the company indicate potential for future growth, especially as it expands its service offerings and enhances user experience. Analysts recommend that investors keep an eye on the competitive landscape and Zomato’s quarterly earnings reports. Overall, Zomato’s share price is a barometer of both the company’s performance and the evolving dynamics of the Indian food delivery market, making it a key investment consideration for those interested in the sector.