Exploring the Shanghai Index: Trends and Market Significance

Introduction

The Shanghai Index, also known as the Shanghai Composite Index, represents a crucial element of China’s financial market. It tracks the performance of all stocks listed on the Shanghai Stock Exchange and is a significant indicator of the health of the Chinese economy. Given China’s status as the world’s second-largest economy, understanding the Shanghai Index is essential for investors globally, particularly as it reflects broader economic trends and investor sentiment in Asia.

Current Trends and Developments

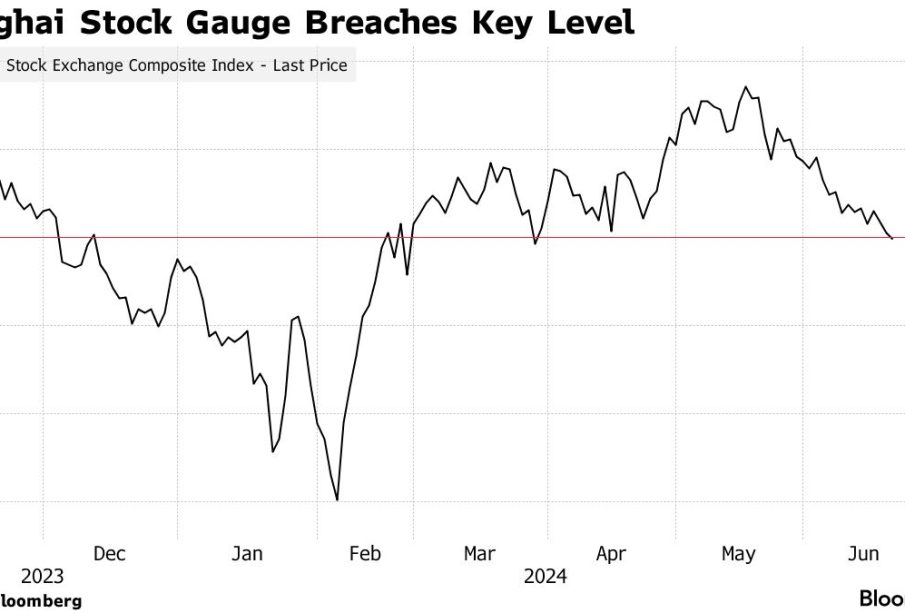

As of October 2023, the Shanghai Index has experienced fluctuations influenced by various factors such as domestic policy changes, global economic conditions, and investor confidence. In recent months, economic recovery has been a mixed bag, as indicators show improvements in certain sectors while others continue to face challenges. For instance, industrial output saw a slight increase, pushing the index higher, yet consumer spending remains sluggish, which raises concerns about sustained growth.

In a recent analysis, the index has shown resilience, recovering from earlier dips attributed to policies aimed at curbing real estate speculation and ensuring financial stability. The introduction of incentives for technology sectors and green energy investments has also contributed positively to investor sentiment. Market analysts predict that these sectors could drive future growth in the Shanghai Index, suggesting a cautiously optimistic outlook for the next quarter.

Significance for Investors

The Shanghai Index is not just critical for domestic investors; it holds significance for international investors as well. Many global funds and investment strategies now incorporate the index due to China’s rising influence on international markets. Monitoring the Shanghai Index can provide insights into potential investment opportunities and risks, especially as China continues to transform its economy towards technology and consumer-driven growth.

Conclusion

Overall, the Shanghai Index serves as a key indicator of the economic climate in China and the Asia-Pacific region. With current trends suggesting a balancing act between recovery and challenges, it is essential for investors to remain informed about the developments impacting the index. As China navigates its post-pandemic recovery and approaches significant economic reforms, the Shanghai Index will likely remain a focal point of interest for both local and international markets.