Current Trends in Oracle Share Price

Introduction

The Oracle share price has become a focal point for investors and market analysts, especially given the company’s strong performance and its growing influence in the tech sector. As one of the leading providers of enterprise software and cloud solutions, fluctuations in Oracle’s stock can significantly impact shareholder value and the wider market.

Recent Developments

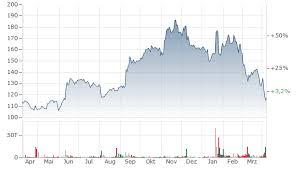

As of October 2023, the Oracle share price stands at approximately $85 per share, reflecting a steady increase of 10% over the past month. This rise comes amid a broader trend of increasing investment interest in cloud computing companies as businesses shift their operations online. Recently, Oracle reported a quarterly revenue growth of 18%, driven by its cloud infrastructure and SaaS (Software as a Service) divisions. This financial performance has bolstered investor confidence, further contributing to the uptick in share prices.

Moreover, with the advent of artificial intelligence and machine learning, Oracle has aggressively expanded its offerings. The announcement of new features integrated with AI capabilities has been met with optimism among investors, signaling Oracle’s commitment to staying ahead in a highly competitive market.

Market Analysis

Financial analysts suggest that the Oracle share price could continue to rise as the company capitalizes on the ongoing digital transformation across various industries. Major firms are increasingly relying on Oracle’s suite of cloud services, which positions the company well for sustained growth. Investment firms have recently adjusted their price targets for Oracle, with predictions suggesting potential growth to within the $90-$95 range in the next quarter.

Investor sentiment is likely to remain positive, especially after Oracle’s recent partnership announcements with major technology firms, indicating a collaborative approach to enhance their cloud offerings. These partnerships could provide Oracle with an edge in acquiring new customers and expanding its market share.

Conclusion

The Oracle share price is reflecting a promising outlook, driven by robust financial results and strategic initiatives. For investors, keeping an eye on Oracle’s performance metrics and market positioning will be crucial as they navigate the tech landscape. As digital adoption continues to rise and Oracle enhances its role in the cloud sector, the share price may see further appreciation, making the company’s stock an intriguing option for both short-term and long-term investing strategies.