Recent Trends in Tesla Stock and Market Insights

Introduction

The performance of Tesla stock has become a focal point for investors and market analysts alike, especially in the context of the rapidly evolving electric vehicle (EV) landscape. As one of the most valuable companies in the world, Tesla’s stock movements reflect broader trends in technology, sustainability, and consumer preferences. Current fluctuations in Tesla’s stock price provide insight not just into the company’s health, but also the future of the entire automotive industry.

Current Market Status

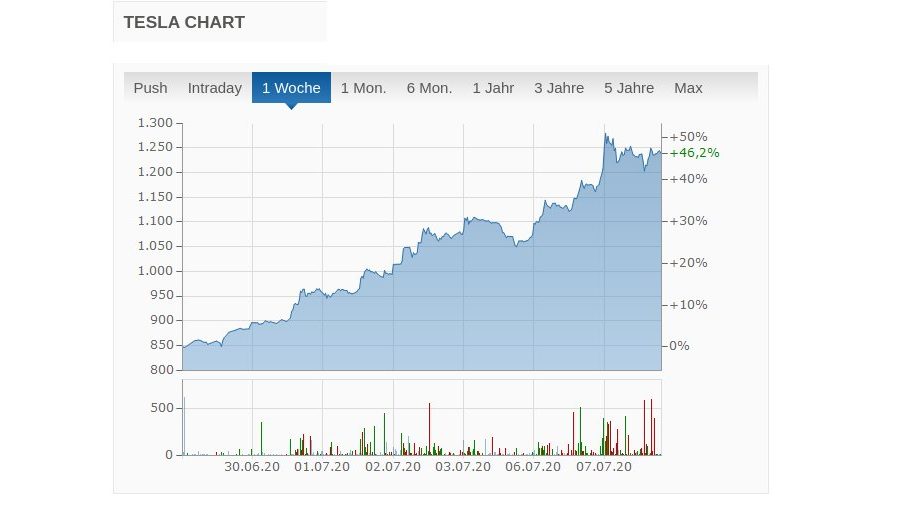

As of October 2023, Tesla’s stock has experienced significant volatility, responding to both global economic challenges and internal company developments. Recently, shares have seen a notable increase after the announcement of new production facilities and advancements in their semi-automatic driving technologies, reaffirming investor confidence in Tesla’s growth trajectory. According to market analysts, the stock has risen approximately 25% over the past quarter due in part to these announcements, which indicate Tesla’s commitment to enhancing its production capabilities and expanding its product line.

Factors Influencing Tesla Stock

Several key factors have driven the current stock movements. Firstly, the global push for EV adoption fueled by government policies and consumer demand has positioned Tesla at the forefront of the market. Additionally, quarterly earnings reports have consistently exceeded expectations, showcasing robust sales performance and profitability. Analysts have also highlighted Tesla’s formidable presence in emerging markets, particularly in Asia and Europe, where demand for EVs continues to rise.

Outlook and Predictions

Looking ahead, many experts foresee a mixed environment for Tesla’s stock. While the fundamentals appear strong, the overall market sentiment will play a crucial role in influencing stock performance. Concerns surrounding inflation, supply chain disruptions, and interest rate hikes could impact investor behavior moving forward. However, if Tesla continues to innovate and expand its market reach, the long-term outlook remains positive, with several analysts projecting potential gains of 15-20% in the upcoming year.

Conclusion

In summary, Tesla stock not only reflects the company’s strategic initiatives and growth patterns, but it also embodies investor sentiment towards the future of the electric vehicle industry. While short-term volatility may pose challenges, the underlying trends suggest that Tesla is well-positioned for future success. Investors should keep a close eye on the company’s announcements, market developments, and broader economic indicators when considering their positions in Tesla stock.