Everything You Need to Know About BBMP Property Tax in 2023

Introduction

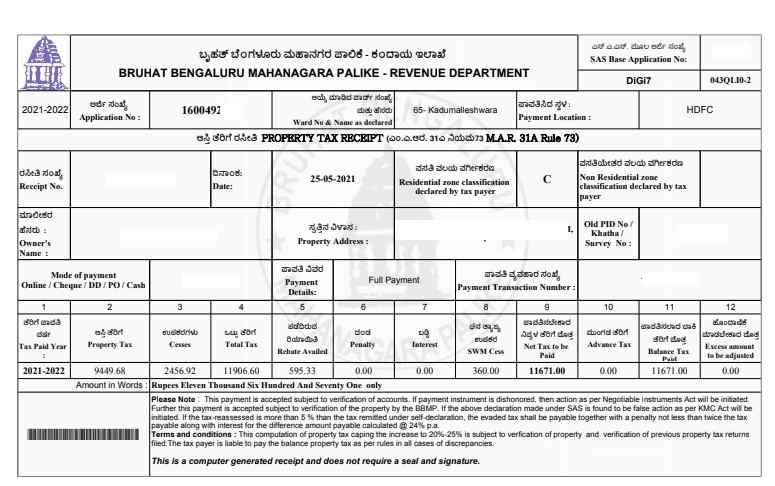

The Bruhat Bengaluru Mahanagara Palike (BBMP) oversees property tax collection in Bangalore, a vital income source for local governance. Understanding property tax in BBMP is essential for residents, as it contributes to municipal services like waste management, road maintenance, and infrastructure development. With recent changes implemented in 2023, staying updated on property tax regulations and deadlines is crucial for homeowners and property investors.

Recent Changes in BBMP Property Tax

In 2023, the BBMP announced several significant changes to the property tax structure aimed at enhancing transparency and efficiency. One of the key changes is the introduction of a new self-assessment method, allowing property owners to estimate their own taxes based on the updated guidelines provided by the authority. This system is intended to simplify the tax-filing process and reduce bureaucratic delays.

Furthermore, the BBMP has established an online portal to facilitate easy payment of property taxes. Residents can now access their tax details, make payments, and receive instant acknowledgments without the need to visit physical offices. This initiative is part of BBMP’s Digital India push, aimed at promoting e-governance in the city.

New Tax Rates and Compliance

For the financial year 2022-2023, the property tax rates have been revised slightly. Residential properties have a different tax slab compared to commercial properties, encouraging more homeowners to comply with tax regulations. The tax computation now factors in the property’s location, size, age, and type, ensuring a fair assessment by the BBMP. The due date for property tax payment remains March 31, 2023, for homeowners who wish to avoid penalties. Delayed payments will incur interest as per BBMP regulations, making timely compliance essential.

Challenges and Public Response

Despite the advancements, some residents have expressed concerns regarding the new self-assessment method, fearing it may lead to undervaluation or disputes. The BBMP is addressing these concerns by providing clear guidelines and support to residents through workshops and online resources. Public forums have been set up to gather feedback and enhance citizen engagement in the tax evaluation process.

Conclusion

Understanding BBMP property tax is crucial for property owners in Bangalore, especially with the changes introduced in 2023. These reforms aim to streamline tax assessments and foster better compliance, ultimately benefiting municipal governance and public services. As BBMP continues to evolve its approach to property tax Collection, residents are encouraged to stay informed and actively participate in local governance initiatives. Timely payment and awareness of the changes will ensure a smooth experience for all property owners.