Understanding the BSE Midcap Index: Importance and Trends

Introduction

The BSE Midcap Index holds a critical place in India’s financial ecosystem, serving as a benchmark for mid-sized companies listed on the Bombay Stock Exchange (BSE). This index provides investors with insights into the performance and trends of a crucial segment of the Indian economy, making it an essential tool for investment decisions and market analysis.

Current Performance of the BSE Midcap Index

As of October 2023, the BSE Midcap Index has displayed notable performance, reflecting the resilience and growth potential of mid-cap stocks. The index has shown a year-to-date increase of approximately 15%, signaling strong investor confidence amid economic recovery following the pandemic. Key sectors contributing to this growth include pharmaceuticals, consumer goods, and technology, with several mid-cap companies reporting robust quarterly earnings.

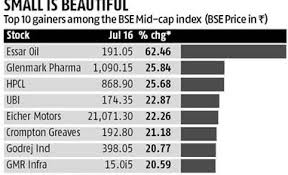

The index recently reached a six-month high, driven primarily by favorable government policies, increased consumer demand, and positive global economic cues. Noteworthy stocks within the index, such as Tata Power and Godrej Properties, have seen significant upticks in their prices, further solidifying the midcap segment’s importance in the overall market.

Factors Influencing the BSE Midcap Index

Several factors have been contributing to the upward trend of the BSE Midcap Index. Increased foreign direct investment (FDI), coupled with a revival in manufacturing activities, has bolstered market sentiment. Additionally, improved infrastructure spending by the government and strong initiatives for the digital economy have provided a conducive environment for mid-sized companies to thrive.

Furthermore, analysts at major brokerage firms have been bullish on mid-cap stocks, citing their potential for higher growth compared to large-cap stocks. This shift in focus towards mid-cap investments can be attributed to their relatively lower valuations, which offer attractive entry points for investors looking for growth opportunities.

Conclusion

The BSE Midcap Index serves not only as a barometer for mid-sized companies in India but also as an indicator of investor sentiment and economic recovery. As we move toward the end of 2023, continuous monitoring of this index will be crucial for investors, as it could indicate larger trends in the Indian stock market and economy. Looking ahead, the prospects for mid-cap companies appear promising, as they are set to benefit from economic policies, consumer demand, and global market dynamics, making the BSE Midcap Index a focal point for strategic investment decisions.