Indigo Share Price: Trends and Insights for Investors

Introduction

The performance of airline stocks can significantly influence investment decisions in the stock market, and Indigo Airlines is no exception. As India’s largest airline by market share, tracking the Indigo share price provides crucial insights into the broader aviation industry and economy. In recent weeks, however, there has been heightened interest in Indigo’s share performance following various economic indicators, fuel prices, and travel demand recovery post-pandemic.

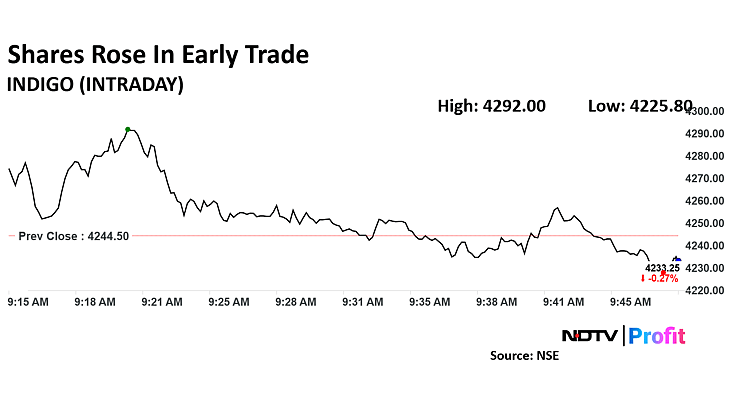

Current Market Performance

As of this week, Indigo’s share price has shown considerable fluctuations. It currently trades around INR 2200, reflecting a recent upswing due to positive quarterly earnings reports. Analysts had projected a steady growth trajectory owing to increased passenger traffic and operational efficiency. The airline reported a 20% rise in revenue for the last quarter compared to the same period last year, benefitting from the resurgence of domestic travel.

Market analysts noted that the recent reduction in fuel prices has also played a crucial role in boosting investors’ confidence. Indigo’s management has focused on streamlining operations and optimizing costs, allowing it to remain competitive. Additionally, the airline’s expansion plans, including adding more flights to international destinations, are expected to further enhance share value.

Factors Influencing Share Price

Several factors contribute to the Indigo share price movements. Key among them are fluctuations in global crude oil prices, which directly impact operational costs. Analysts are also keeping a close watch on government regulations, competition from other airlines, and macroeconomic indicators. Consumer sentiment following the pandemic has shown an upward trend, which supports growth in ticket sales and, consequently, the airline’s stock performance.

Conclusion

In summary, tracking the Indigo share price is vital for investors looking to capitalize on the airline’s growth potential. With economic recovery in full swing and operational improvements underway, Indigo is well-positioned for further growth. Investors should remain informed on market trends and the broader economic landscape, as they will shape future share price movements. Overall, Indigo’s resilience and strategic planning bode well for future performance in the aviation sector, making it a stock worth monitoring closely.