Current Trends in SBIN Share Price: Analysis and Insights

Introduction to SBIN Share Price

The share price of State Bank of India (SBIN) is a significant metric for both investors and analysts, reflecting the bank’s financial health and market performance. As one of the largest public sector banks in India, fluctuations in SBIN’s share price can indicate broader trends in the Indian banking sector and the economy as a whole. Investors often look at these trends to make informed decisions about buying or selling shares.

Recent Performance of SBIN Shares

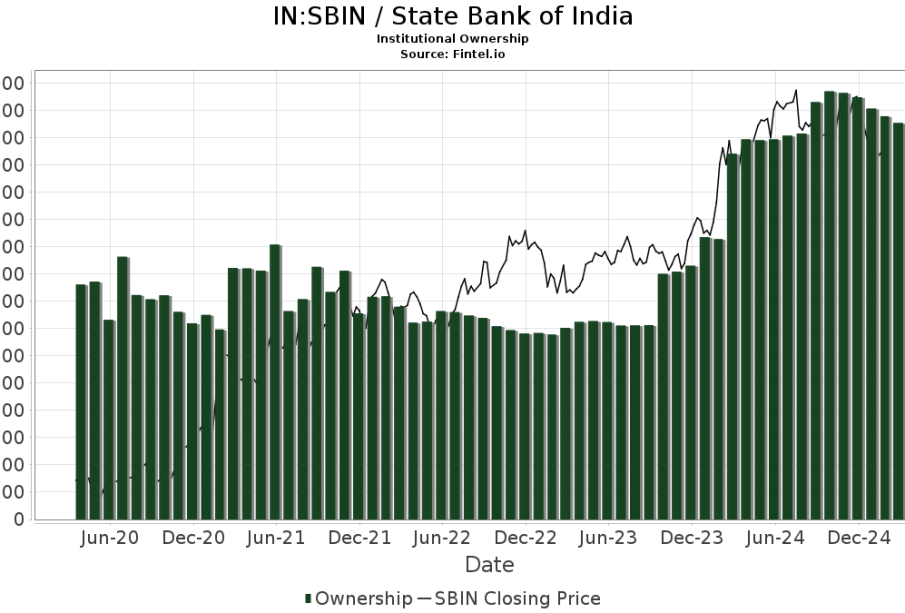

As of October 2023, SBIN’s share price has seen substantial movements. Recent reports indicate that the share price has experienced an upward trend, primarily due to strong quarterly financial results and improved asset quality. The bank reported a net profit of ₹13,265 crore for Q2 FY2023, a remarkable increase of 33% compared to the previous year, leading to positive sentiment in the market.

Currently, SBIN shares are trading around ₹650, a significant increase from earlier in the year. Analysts suggest that this growth is attributed to enhanced credit growth, reduction in non-performing assets (NPAs), and a diversified loan portfolio. Additionally, the announcement of a strategic collaboration with fintech companies has contributed to the optimism surrounding the bank’s digital transformation initiatives, attracting more investors.

Market Influences on SBIN Share Price

Several factors have influenced SBIN’s share price recently. Global economic conditions, interest rate changes by the Reserve Bank of India, and government policies significantly impact banking stock valuations. The ongoing challenges from inflation, international market volatility, and potential tightening of monetary policy can affect investor sentiment and liquidity in the banking sector.

Moreover, competition from private banks and fintech companies poses both a challenge and a potential for innovation for SBIN. Analysts are keeping a close watch on these dynamics, as they play a crucial role in determining future price movements.

Conclusion and Outlook

Looking ahead, the SBIN share price is expected to maintain its momentum, provided that the bank continues to improve its operational efficiency and asset quality. Experts forecast a target price of around ₹700-₹720 in the coming months, hinged on steady economic recovery and strong financial performance.

For investors, keeping an eye on SBIN’s performance will be crucial as it sets the tone for public sector banks in India. Whether you are considering entering this market or are a long-term shareholder, understanding the factors that influence SBIN share price can help guide strategic investment decisions.