Understanding the Nasdaq 100: Key Insights for Investors

Introduction to Nasdaq 100

The Nasdaq 100 is a stock market index that includes 100 of the largest non-financial companies listed on the Nasdaq stock exchange. This index is a crucial benchmark for investors as it represents a significant portion of the U.S. economy, particularly the technology sector. Given recent fluctuations in the market, understanding the Nasdaq 100 is essential for making informed investment decisions.

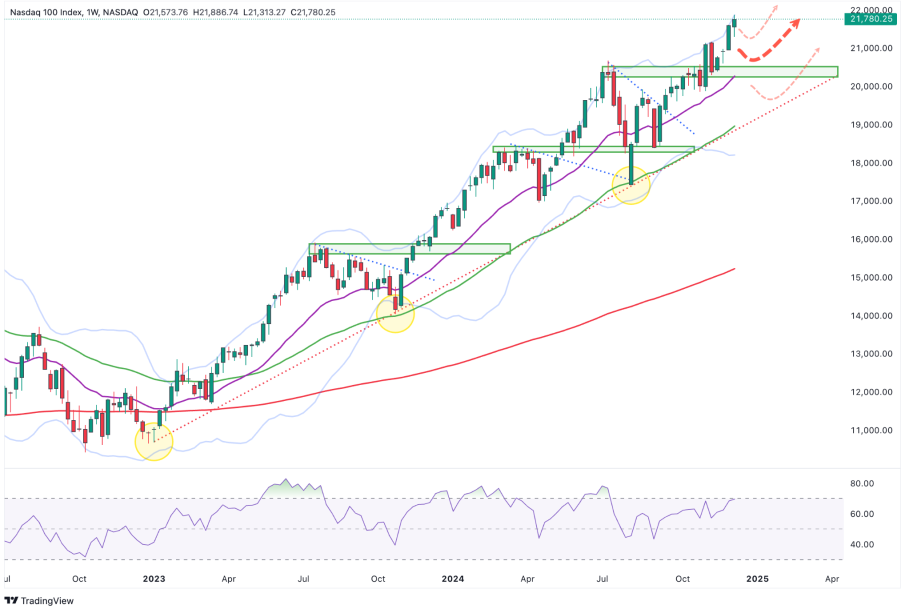

Current Trends and Performance

As of October 2023, the Nasdaq 100 has seen remarkable growth, with technology giants like Apple, Amazon, and Microsoft leading the way. The index recently hit a record high, largely driven by advancements in artificial intelligence and robust consumer demand in tech products and services. Analysts have noted that the index’s performance is closely tied to interest rates and inflation trends, with a shift towards stability in the economy potentially favoring tech stocks.

Factors Influencing the Nasdaq 100

The performance of the Nasdaq 100 is influenced by various factors, including earnings reports from major tech companies, macroeconomic indicators, and global events. In recent months, positive earnings surprises have propelled many tech stocks higher. Additionally, investors’ sentiment regarding interest rate hikes by the Federal Reserve impacts market volatility. As tech companies navigate supply chain challenges and evolving consumer behaviors post-pandemic, their adaptability plays a critical role in the index’s future performance.

Investment Outlook

Looking forward, many financial analysts predict continued volatility in the Nasdaq 100 as external economic pressures persist. However, experts suggest that long-term investors remain cautiously optimistic, citing the continued innovation and growth potential within the technology sector. As companies within the index adapt to new economic landscapes, traders will need to stay informed about market conditions and conduct thorough analyses before making investment decisions.

Conclusion

The Nasdaq 100 remains a vital part of the investment landscape, reflecting current economic trends and the performance of significant tech companies. For investors, maintaining awareness of market shifts and understanding the components that drive the Nasdaq 100 can result in more informed investment choices. As we move into the final quarter of 2023, a thorough analysis of market conditions will be essential for navigating the complexities of investing in the Nasdaq 100.