Understanding GST Payment and Its Impact on Businesses in India

Introduction

Goods and Services Tax (GST) has been a revolutionary step in the taxation system of India since its implementation on July 1, 2017. It simplifies the tax structure, eliminates the cascading effect of taxes, and integrates the economy of the nation. Understanding GST payment is vital for businesses, as it affects pricing, compliance, and overall operational efficiency. The relevance of GST continues to grow amidst ongoing discussions on economic reforms and tax compliance measures, making it crucial for business owners to stay informed.

Current Status of GST Payments

According to the latest reports by the Goods and Services Tax Network (GSTN), the government collected INR 1.46 lakh crore in GST revenue in August 2023, showcasing an increase of 14% compared to the same month of the previous year. This increase reflects effective tax collections, higher compliance by businesses, and a resilient economy. Businesses are required to file GST returns and make payments on a monthly and quarterly basis, depending on their turnover.

Challenges Faced by Businesses

Despite the progress, several challenges remain for businesses regarding GST payments. Many small and medium enterprises (SMEs) struggle with digital literacy, making it difficult to navigate the online GST portal for filing and payments. Additionally, the complexities of determining applicable tax rates for various goods and services pose another hurdle. This often leads to confusion and potential non-compliance, impacting their financial stability and legal standing.

Future of GST Payments

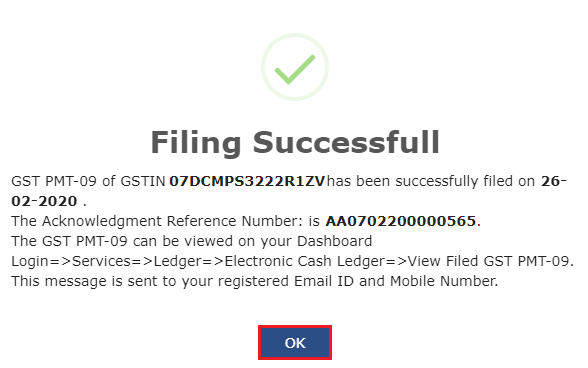

As the government emphasizes digital transactions, the future of GST payments appears to be moving towards greater automation and efficiency. Initiatives like e-invoicing, which is mandatory for businesses with a turnover above INR 10 crore, aim to reduce tax evasion and streamline the payment process. With ongoing updates and improvements, industry experts forecast an even smoother GST payment process which can greatly benefit businesses in the long run.

Conclusion

The significance of understanding GST payment cannot be overstated for anyone operating a business in India. As compliance becomes increasingly stringent, staying informed about GST regulations and payment processes is crucial for avoiding penalties and maximizing business potential. With the anticipated technological advancements and government initiatives aimed at improving the taxation system, it will be important for companies to adapt and evolve in this changing landscape. By investing time in learning about GST payment, businesses can not only ensure compliance but also reap the benefits of a better-structured tax environment.