Latest Insights on Manappuram Share Price

Introduction

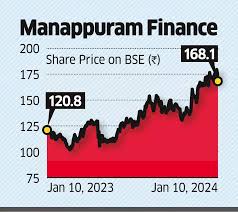

Manappuram Finance Limited, a prominent name in the gold loan segment and financial services in India, has recently seen fluctuations in its share price, making it a key topic for investors and market analysts alike. Understanding these changes is crucial for potential investors and those already holding shares in the company, as it reflects market confidence and company performance.

Current Share Price Trends

As of the latest trading session, Manappuram’s shares have shown significant movement, hovering around INR 114.85, with a volatility that is drawing attention from traders. This represents a slight decrease from the last quarter, where it peaked at INR 130. Analysts attribute this to various factors, including economic conditions, changes in gold pricing, and competitive pressures in the financial sector.

Factors Influencing Share Price

Several factors have influenced the share price of Manappuram recently:

- Gold Prices: As a major player in the gold loan market, fluctuations in gold prices have a direct impact on Manappuram’s financial health. Gold prices have remained volatile due to global economic uncertainty.

- Regulatory Changes: New regulations in the financial services sector can alter operational dynamics and investor perceptions. Recently, stricter lending norms have been introduced, prompting investors to reassess the company’s growth potential.

- Quarterly Earnings Reports: Manappuram’s quarterly earnings have shown a mixed performance. The latest results indicated a slight dip in profits, which could impact investor confidence.

Market Sentiment and Future Projections

Market analysts are divided on the future of Manappuram’s share price. Some predict a rebound as gold prices stabilize and the company adjusts to new regulations, while others caution about ongoing competition in the personal finance space. Short term trends may remain volatile, but long-term growth prospects are generally viewed positively, especially if the company continues to innovate and expand its loan offerings.

Conclusion

In conclusion, potential investors and current shareholders of Manappuram Finance should keep a close eye on the company’s share price movements alongside gold market trends and regulatory impacts. The financial services industry is highly dynamic, and informed trading decisions could lead to favorable outcomes. As always, conducting thorough research and consulting financial advisors remains advisable before making investment decisions.