Current Trends in Cisco Share Price: An Investor’s Perspective

Introduction

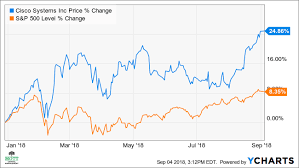

The share price of Cisco Systems, Inc., a leading technology company specializing in networking hardware and telecommunications equipment, holds significant importance in the stock market. As a component of various stock indices, Cisco’s performance is closely monitored by investors, analysts, and market enthusiasts alike. Understanding the fluctuations in Cisco’s share price can provide insights into the broader technology sector and investment opportunities for shareholders.

Current Market Standing

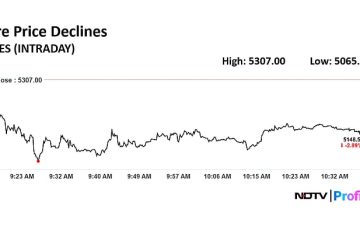

As of October 2023, Cisco’s share price has shown resilience amidst a fluctuating market. Recent reports indicate that the stock was trading around $55, reflecting a steady growth trajectory since the beginning of the fiscal year. The tech giant has been proactive in its strategies to adapt to changing market dynamics, including a strong focus on cybersecurity and cloud-based solutions, which have bolstered investor confidence.

Recent Developments Impacting Share Price

A variety of factors have contributed to the current valuation of Cisco’s shares. The company recently reported better-than-expected quarterly earnings, driven by increased demand for its networking solutions and services. Cisco’s commitment to innovation, including investments in artificial intelligence and Internet of Things (IoT) technologies, has also played a significant role in enhancing its market position.

Industry analysts have suggested that the ongoing digital transformation across enterprises is a fundamental driver of growth for Cisco. Additionally, the global push for enhanced cybersecurity measures has positioned Cisco as a key player in this competitive landscape, influencing positive market sentiment.

Market Forecast

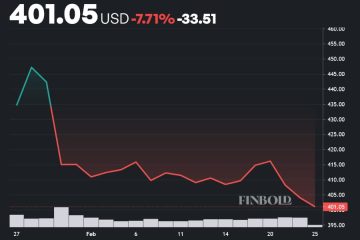

Experts predict that Cisco’s share price will continue to experience fluctuations based on various factors, including economic conditions, emerging technologies, and competitive pressures. The upcoming earnings reports and any announcements regarding strategic acquisitions or partnerships may also significantly influence its stock performance.

Conclusion

For investors, monitoring Cisco’s share price is essential in gauging the company’s market performance and potential long-term benefits. As technological advancements continue to reshape the industry, Cisco’s ability to innovate and adapt will likely be crucial in maintaining its competitive edge and achieving sustainable growth. Investors should remain vigilant and keep abreast of news and developments regarding Cisco to make informed investment decisions in this dynamic market environment.