Understanding the Small Cap Index and Its Market Impact

Introduction

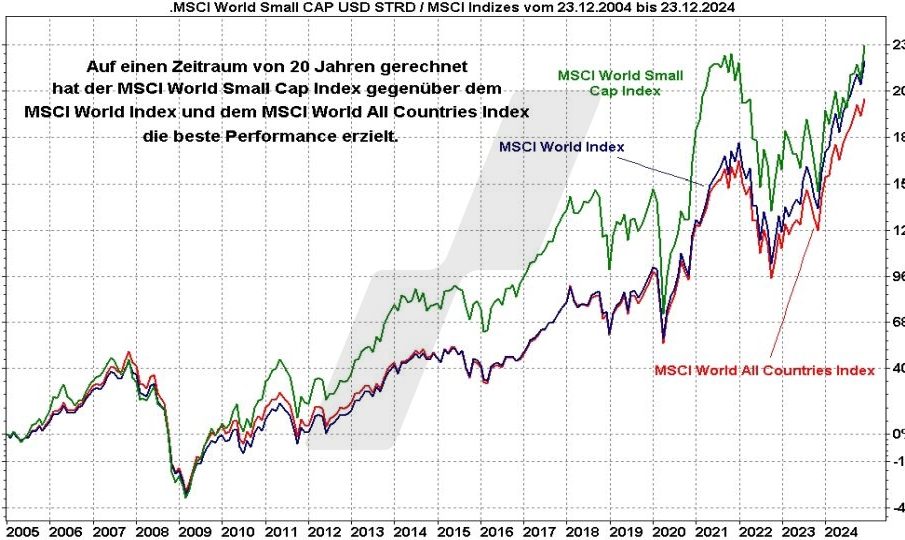

The Small Cap Index has become a focal point for investors looking to diversify their portfolios and tap into the growth potential of smaller companies. As larger companies often dominate the headlines, small-cap stocks can offer unique opportunities for high returns. These stocks, typically defined as companies with market capitalizations under $2 billion, represent a significant portion of the equity market. As market volatility continues, understanding the performance of the Small Cap Index is more crucial than ever for investors seeking to navigate the financial landscape.

Current Trends in the Small Cap Index

Recent data shows that the Small Cap Index has shown a remarkable performance, outpacing larger indices such as the Nifty 50 and the Sensex in 2023. According to a report from the National Stock Exchange of India, the Small Cap Index has witnessed a rise of approximately 15% in the past year, fueled by a post-pandemic economic recovery and increasing investor interest.

Experts attribute this shift to several emerging trends, including a robust domestic consumption environment, increased investments in technology, and the resurgence of infrastructure projects. Notably, sectors such as small-scale manufacturing, consumer goods, and information technology have driven much of the growth within the small-cap arena.

Investment Opportunities and Risks

While investing in the Small Cap Index can provide lucrative returns, it is essential to approach with caution. Smaller companies often face higher volatility and less liquidity, which can lead to sharp price fluctuations. Additionally, they might not have the same level of resources or market share as larger corporations, making them vulnerable to economic downturns.

Investors are advised to conduct thorough due diligence before diving into small-cap investing. Diversifying one’s portfolio and considering mutual funds or exchange-traded funds (ETFs) that focus on small-cap stocks can be intelligent strategies for mitigating risk.

Conclusion

The Small Cap Index represents an exciting component of the Indian equity market, reflecting the potential for high growth in a recovering economy. As investors continue to seek avenues for wealth creation in an ever-changing market, small-cap stocks may offer a compelling option. However, with opportunities come risks; thus, it is essential for investors to remain informed and cautious. Moving forward, market analysts predict that small-cap stocks may continue to thrive, but only if the broader economy maintains its growth trajectory.